By Jordan Chapman

As we look back on a successful Women’s History Month, wrap up National Inventor’s Month, and begin celebrating National Small Business Week, we are proud to shed light on our recently released research on women’s entrepreneurship in high-yield and high growth industries. Led by women-owned consulting firm Kapur Energy Environment Economics, LLC, this project was initiated in 2023 and the final results will be released in October of 2024. The preliminary findings of this research are compiled in an extensive 195-page report entitled, “An Illuminating Moment: Lighting a Pathway for Women STEM Entrepreneurs,” which includes a literature review, data and policy analysis, and preliminary recommendations to support women innovators.

We already knew that women’s participation in STEM, particularly through entrepreneurship, is essential for progress. A woman led the team that pioneered the COVID-19 vaccine at Harvard University, a woman invented Kevlar, a woman first identified the greenhouse effect, a woman created technology that now serves as the basis for Wi-Fi and Bluetooth, a woman wrote the first computer program, a woman built the Brooklyn Bridge, a woman discovered the composition of the Earth’s inner core, a woman discovered what the Earth’s ocean floor looks like, a woman pioneered new methods for treating cataracts and on top of it all, a woman invented chocolate chip cookies. In other words, we know the names we must share to uplift women’s contributions in STEM, and thanks to this research, we now know the numbers too.

At NWBC, we raise awareness of the obstacles women face, but equally strive to emphasize the potential opportunities that lie ahead as well. With that in mind, below are some of the major highlights of the preliminary findings.

| On the one hand… | But on the bright side… |

| There are 733,880 fewer female-owned STEM firms than male-owned firms. | When you break this disparity down by employer vs. non-employer firms, the gap is much narrower (less than 200,000 firms) for non-employer firms, which make up the majority of STEM firms as a whole. Women business owners are also more likely to own non-employer firms across industries. |

| According to the Institute for Women’s Policy Research, if current rates of patenting do not significantly increase, the gender patenting gap will not close until 2092 at the earliest. The global STEM gender gap was also recently illustrated in research conducted by LinkedIn, which suggested the STEM skills gap would take 45 years to close, while the STEM employment gap would take 90 years to close. | STEM firms owned by Black/African American, Hispanic, and Native American women outnumber their male-owned counterparts. Women of color are clearly making outstanding strides in gender equity in STEM entrepreneurship, which matches what we are seeing when it comes to the recent surge in new business starts. |

| Women are underrepresented in STEM education and the workforce. As referenced in this report and expounded upon in NWBC’s 2023 Annual Report, women make up nearly half of the workforce but only 27 percent of the STEM workforce and receive the majority of the bachelor’s degrees, but less than 25 percent of those in engineering, computer science, and physics. | When looking at business owners under the age of 45, STEM businesses owned by women outnumber those owned by men. It will take generations to bridge disparities in STEM education and workforce participation for women, but in entrepreneurship, the signs of progress are superb. |

| Veteran male-owned businesses in STEM outnumber their female-owned counterparts by a factor of eight. | According to the U.S. Department of Labor, women only make up 10 percent of all veterans, indicating that they may actually be overrepresented as STEM business owners. |

| There is only one state where the proportion of women-owned STEM firms is close to or greater than that of their male-owned counterparts: Maine. | Women-owned firms make up 39.1 percent of all firms in the U.S, as shared in NWBC’s 2023 Annual Report. For many states, the proportion of women-owned STEM firms is higher than this 39.1 percent. Put another way, although the proportion of women STEM entrepreneurs may not be equal to that of men, in many states, the proportion of women STEM entrepreneurs is higher than the average proportion of women entrepreneurs across all industries. While as a country, we have a lot of work to do to close the gap in women’s STEM entrepreneurship, many states have obviously cracked the code. |

The economic and societal benefits of increasing women’s STEM participation also deserve repeating. Researchers have previously found that if women, people of color, and people from low-income families invented at the same rate as other groups that do not face comparable discrimination and structural barriers, U.S. innovation would quadruple. A study commissioned by the U.S. Patenting and Trademark Office (USPTO) also found that commercialized patents could increase by 24%, and gross domestic product (GDP) per capita could go up by 2.7% if the gender gap in patenting were closed. Recently published research from USPTO has also found that “women’s participation in patenting… is growing and associated with more diverse teams and patents with higher economic value.” Women-owned firms generate over twice as much per dollar invested as their male-owned counterparts and if the gender gap in entrepreneurship closed, global GDP would increase by 3-6 percent. When it comes to domestic gains, an additional $7.9 trillion in revenue would be added to the U.S. economy if the average revenue gap between women- and men-owned businesses is closed.

As a leading voice in women’s entrepreneurship, we have a few ideas for what could bring clearer skies and gender parity in STEM entrepreneurship, including supporting women’s STEM entrepreneurial education, investment, and outreach, leveraging ongoing efforts encompassed in the Investing in America agenda to connect women to 21st century opportunities, bolstering workforce entry and re-entry initiatives to get and keep women in the STEM pipeline, improving the incubator and accelerator system, and maintaining a viable pathway to commercialization and intellectual property for women entrepreneurs. You can read more about those in our 2023 Annual Report, connect to the conversations we are having today by learning more about our Access to Opportunity roundtable and uncover new potential gamechangers in the preliminary findings research report. But if necessity is the mother of invention, then we all have a part to play in ensuring women entrepreneurs have the access to the capital, opportunities, and resources they need, so we can all bask in the warm glow of their lightbulb moments.

By Erin Hustings

Commemorative months are a tricky thing. On one hand, spotlighting a community or cause generates interest, excitement, and innovations, especially from actors who don’t focus there every day. On the other, the issues we build calendar celebrations around aren’t ones we can really address just once a year. Pursuing parity for women entrepreneurs during Women’s History Month is a prime example.

To make the most of the momentum that went into marking Women’s History Month 2024, we need to carry its lessons forward throughout the year. At the National Women’s Business Council (NWBC), we had the opportunity to get out and meet scores of women in business in March, and we heard over and over again that they are ready to go and poised for success. The energy was palpable, and matched what statistics tell us: women are driving an historic small business boom that has the potential to democratize wealth creation like never before.

Census Bureau data indicate that Americans started nearly 5.5 million businesses in 2023, the highest annual total on record. Between 2019 and 2023, the number of firms owned by women grew by 13.6%, compared to 7.0% for male-owned companies, according to the 2024 Impact of Women-Owned Businesses report from Wells Fargo, Ventureneer, CoreWoman and WIPP Educational Institute. Woman-owned firms’ revenue increased by 27.3%, outpacing male-owned firms’ growth of 15%. The report also found that if we were able to maximize the impact of women-owned businesses and have women achieve the same average revenues as firms owned by men, it would add $7.9 trillion to the economy.

A flourishing of opportunity for newly minted women entrepreneurs also means there’s greater demand for advice and partnership among relatively less-experienced entrepreneurs, while more established firms are asking “what’s next?” Newer firms we spoke with cited a lack of networks, banking relationships, and collateral and experience in business, compounding negative presumptions about women’s businesses to limit access to capital. Businesses looking to scale noted mounting challenges in completing and utilizing business certification systems that demand duplication of effort to sell to different agencies, levels of government, and sectors.

Women-owned businesses are exploding just as billions of dollars in public investment in infrastructure, renewable and clean energy, advanced manufacturing and technological innovation is arriving in communities around the country. The funding is intentionally destined for underserved and underdeveloped places, and has the potential to expand opportunity for workers and owners, including women and women of color, who’ve been underrepresented in those industries. There is more to be done to realize this vision. In March, NWBC met an entrepreneur who had grown an energy industry business from zero to 200 employees in just the past couple of years, but found out that her company was not yet supplying Invest in America projects.

A common theme emerged from each engagement and conversation: the economy has evolved, and women have risen to occasion, displaying determination and creativity as first time or expansion minded entrepreneurs. Now it’s time for the institutions and systems that support companies to follow suit and move beyond mechanisms that give those with the longest legacy in business a leg up. For instance, because past performance is considered one of the most valuable indicators of qualification for a loan or ability to fulfill a contract, the new businesses that disproportionately have been started by women over the past several years face an uphill climb to access a fair share of capital and available business opportunity.

For the next 11 months, NWBC will share its body of responsive policy recommendations with partners and stakeholders to ensure that new and emerging businesswomen are equipped to succeed, and find opportunities and customers that recognize their strengths. Ideas like performance incentives for contracting officers who excel at engaging underserved businesses, and enhanced hands-on back-office services and technology support for new entrepreneurs, can change the landscape for women in business, and not just during the month of March.

NWBC will also form 2024 recommendations that reimagine routine business processes and supports to serve women entrepreneurs. While we’re already seeing some of this progress through initiatives like expansion of the Women’s Business Center program, provision for a national paid family and medical leave program in the President’s budget, and the centralization of SBA’s certification platforms, the work is not finished. Women and men, families and communities will all benefit when systems are built, and rebuilt, to center women in business.

NWBC Chair Liz Sara Commemorates Black History Month.

Although NWBC has indefinitely postponed its signature #LetsTalkBusiness Roundtable Series, which connects the voices of women entrepreneurs and business owners from across the country to policymakers in the Nation’s capital and helps serve as a springboard for the Council’s annual policy recommendations to Congress, the President, and the Administrator of the U.S. Small Business Administration (SBA), NWBC remains focused on carrying out its critical mission. As was reinforced at our first 2020 #LetsTalkBusiness Roundtable last month in San Juan, Puerto Rico, women business owners are key to helping local and national economies recover from disasters as well as grow and thrive.

Check out this dynamic interview with Dolmarie Mendez, Co-Founder and CEO of Abartys Health at NWBC’s #LetsTalkBusiness Roundtable in San Juan, Puerto Rico.

The National Women’s Business Council (NWBC) is celebrating the anniversary of the passage of HR5050, the Women’s Business Ownership Act. The passage of this legislation, and its resulting impact on women business owners, would not have been possible without some incredible, tenacious women that I am fortunate to have worked with. This week in particular has me reminiscing on the 1986 White House Conference on Small Business and how that set the stage for H.R. 5050. For me, on August 16, 1986 the Conference opened a door I didn’t realize was closed. The biggest lesson we learned was that organizing, educating, and cultivating partnerships is paramount.

HR 5050 was historic – it only took 103 days from introduction to passage. On October 25, 1988, President Ronald Reagan signed H.R. 5050, making it the law of the land. This unprecedented piece of legislation gave women business owners in the United States critical resources to build their enterprises and succeed in their respective fields.

To so many women around the country, including myself, H.R. 5050 was not just another piece of legislation. It was the basis on which women gain success in business. So many women start with nothing more than a great idea. It takes an incredible amount of hard work and perseverance to turn an idea into a thriving business. The group of women who strategized, working day and night to advocate for this legislation, made their mark on history, and gave women a path to follow. When you empower a woman to succeed, the nation succeeds – and the incredible women who advocated for H.R. 5050 did just that.

Throughout my career I have had the opportunity to scale my business,Terry Neese Personnel Services, was lucky enough to have been appointed to numerous councils and Boards including NWBC and NAWBO, and founded the Institute for Economic Empowerment of Women (IEEW). Thirty years after the passage of H.R. 5050, I can still tell you that what the 1986 White House Conference on Small Business taught us holds true. Women entrepreneurs don’t want a handout. Like all entrepreneurs, women want a level playing field because they can play and win on any field, at any time. Understanding the barriers to opportunity, whether that is access to capital or access to information and finding strong partners in each other is crucial to success. Thanks to H.R. 5050, women in business have excelled, continually reaching new heights, not only in the United States, but also around the world.

Serial entrepreneur Dr. Terry Neese, is a lifelong Oklahoman and has spent over thirty (30) years finding careers for men and women. She is the founder of Terry Neese Personnel Services (TNPS), National Grassroots Network, Women Impacting Public Policy and the Institute for Economic Empowerment of Women (IEEW). Terry’s daughter, Kim Neese, is now the President/Owner of TNPS.

A member of the U.S. Afghan Women’s Council, past national president of the National Association of Women Business Owners (NAWBO), and founder of Terry Neese Personnel Services, Dr. Neese is known as a small business expert and was recognized by Fortune magazine as one of the “Power 30”—the most influential small businesspersons in Washington, D.C. She has been featured throughout several media outlets including MSNBC, FOX News, CNN, SBTV, the Wall Street Journal, the Washington Examiner and the Washington Times.

Whether it is eating turkey and stuffing on Thanksgiving, standing in enormous lines for the deals of Black Friday, or spending hours in front of the computer screen on Cyber Monday, the next few days will be bustling with consumer spending. This year, Small Business Saturday on November 24, 2018 is wedged between Black Friday and Cyber Monday. Created in 2010, Small Business Saturday recognizes the importance of entrepreneurs and small businesses in the community and encourages consumers to shop local.

Over the past eight years, the network of support for small businesses has grown tremendously. Every year, local Chambers of Commerce, business associations, and other small business champions join in on an effort to promote and encourage people to shop local on Small Business Saturday. The National Women’s Business Council (NWBC), the federal government’s only independent voice for women entrepreneurs, understands the importance of this day and has been committed to advocating for women-owned businesses for the past three decades. According to The State of Women-Owned Businesses Report, this year there are an estimated 12.3 million women owned firms in the U.S. accounting for 40% of all businesses. That means 4 out of every 10 businesses in the United States are now women-owned. Consumers should shop local women-owned firms on Small Business Saturday to ensure continued economic growth for women entrepreneurs.

After almost eight years of celebrating Small Business Saturday, consumers have invested about 85 billion dollars in small businesses, and these firms comprise 4.8 trillion dollars of the nation’s Gross Domestic Product according to the Small Business Economic Impact Study (AMEX). The study also found that when a consumer shops at a local business, an average of 67 cents per dollar stays within the local economy unlike an average of 43 cents for large corporations. Small businesses also employ many residents from the local community, thus increasing their community’s overall economic growth through higher profits and lower unemployment. Consumers’ local impact during the busy holiday shopping season can be a game changer. Further, every dollar spent at small businesses creates an additional 50 cents in local business activity as a result of employee spending and businesses purchasing local goods and services.

Although Small Business Saturday only occurs once a year, it is important to shop local all year round. Women across the country continue to break barriers and blaze trails in all industries, and NWBC encourages you to support the women pioneers in your business community. Shopping in your local community will increase revenue, create jobs, and ensure that the smaller ventures have a chance to compete in the larger market. On Small Business Saturday in 2017, the sales and foot traffic for local small businesses decreased. For this upcoming Small Business Saturday on November 24, 2018 consider all the positive benefits to your community.

Throughout these past few weeks, I have had the opportunity to represent the National Women’s Business Council (NWBC) at the Kauffman Foundation’s Annual ESHIP Summit in Kansas City, MS, and at the Diana International Impact Day at Babson College in Wellesley, MA. Both convenings provided unparalleled dialogue between entrepreneurs, researchers, educators, investors, and policymakers.

At the Diana Impact Day, I had the great opportunity to moderate the Conference’s Session A: Connecting Research and Practice, with a specific focus on addressing financing for women entrepreneurs. The session was divided into two panels – the first on pipeline issues and the second on implicit bias. Each panel featured an entrepreneurial research expert, an investor, and a woman entrepreneur. Following each panel discussion, I invited conference attendees to discuss some of the perspectives presented, best practices to address any funding challenges identified, and some of their commitments to action.

Despite the significant gains that women entrepreneurs and business owners have made throughout the 30 years of NWBC’s existence, the dialogue between the panelists and the attendees highlighted the significant challenges and barriers that persist for women entrepreneurs seeking to start and grow their businesses. Most conference attendees were aware of the alarmingly low percentage of venture capital funds that are awarded to women entrepreneurs: just 2.7%. That’s just 2.7% of the total $130 billion in venture capital funding awarded in 2018![1]

At the conclusion of the Session, I provided a policy wrap-up for the conference attendees, where I summarized the recurring themes presented in the panel and roundtable discussions. They were: Access, Education, and Challenging the Institutional Bias in Funding.

Overwhelmingly, I heard from the speakers that acquiring venture capital is about access – access to a network of support and access to a network of potential funders and investors. If it’s all about access, it’s easy to understand why that may present more difficult challenges for diverse entrepreneurs who may be in more rural areas for example, or entrepreneurs who may also be first generation Americans.

I also heard that financing women entrepreneurs is about education, both for the entrepreneurs and the investors. It’s about educating women entrepreneurs how to pitch their already-investable ideas to investors. And as entrepreneur Carla Walker-Miller, founder and CEO of Walker-Miller Energy Services, said “it’s about [teaching women entrepreneurs] to eat the NO’s for breakfast.”

Dr. Alicia Robb, Founder and CEO of Next Wave Impact, pointed out that overcoming some of the challenges to funding women entrepreneurs is also about education and awareness related to alternative forms of capital – finding the right kind of capital for the right kind of entrepreneur. As she pointed out, alternative forms of capital may provide more suitable options for some entrepreneurs. This is also supported by NWBC Kiva and Kickstarter case studies, which revealed promising results for women entrepreneurs seeking to fund their business ventures through crowdfunding platforms.

Both Chip Hazard, General Partner at Flybridge Capital Partners & Investment Partner at XFactor Ventures, and Angela Lee, Founder of 37 Angels & CIO and Associate Dean at Columbia Business School, acknowledged the need for the investor community to recognize some of the institutional bias present in traditional funding structures. Overcoming some of these challenges requires venture capitalists and investors to recognize some of their own internal implicit associations with diverse entrepreneurs and unique or different business ideas. The vast majority of investors continue to be men[2], some of whom may find it difficult to understand or relate to a product that they won’t personally be able to use. A recent story I read about an entrepreneur seeking capital for her smart breast pump comes to mind.[3] In that case, she found great success in funding her venture through Kickstarter.

At the conclusion of the Session, I reiterated the Council’s commitment to listen and engage with diverse members of the the larger entrepreneurial ecosystem, and to continue to elevate their voices to policymakers. I am particularly encouraged by the Council’s new slate of recently installed members, who are especially committed to elevating the often unheard or overlooked voices of women entrepreneurs in rural areas and in STEM fields.

I also invited conference attendees to join in on NWBC’s roundtables around the country, to continue to share their research findings with us, and to stay engaged with us by providing comments and feedback on our public meetings and Annual Report to Congress and the President. It is critical to the work of the Council, as advisors to the President, Congress and the Small Business Administration, that we continue to hear from you.

[1] Funding Female Founders 2018

[2] Why women invest 40 percent less than men?

[3] How grown men behave when pitched for VC funding for smart breast pump?

Baltimore, MD

WASHINGTON, D.C., June 28, 2019 – As part of its ‘Women in Small Business Roundtable Series,’ the National Women’s Business Council (NWBC) held a roundtable in Baltimore, Maryland, on June 25, 2019, to better understand the specific challenges and opportunities for women’s entrepreneurship in Science, Technology, Engineering and Mathematics (S.T.E.M).

The Baltimore roundtable convened local women business owners in S.T.E.M. to share their perspective on the educational pipeline and barriers to accessing capital. The conversation also included educators, investors, organizational representatives, and government officials.

NWBC Council Member Shelonda Stokes welcomed attendees and set the stage for the discussion noting, “As advocates for the nation’s estimated 12.3 million women-owned businesses, NWBC strives to encourage women to start and grow their businesses in S.T.E.M., an industry with proven high-growth potential.”

NWBC Chair Liz Sara prompted the local women entrepreneurs to share the trials and tribulations of starting and growing their businesses All participants recognized the difficulties of establishing credibility as the subject matter expert in a room full of men. One participant transformed a regional software engineering firm into a global software company and noted that access to equity capital was her toughest charge along the way.

The need for mentorship was a prominent theme around the table. Some found counsel within their client base, while others forged connections with personal role models in their industry. Representatives from a local state university noted that tech entrepreneurs had trouble finding properly tailored advice, so the university is hoping to utilize alumni in specialized fields for better guidance. A non-profit organization focused on computer science education stressed a need for relevant curriculums that cater to the interests of young girls and expressed that early, consistent exposure is key when attracting females to these underrepresented fields.

Council Member Monica Stynchula wrapped up the roundtable discussion and reiterated the Council’s commitment to employ the feedback received as a springboard for the Council’s policy recommendations to Congress, the President, and the Administrator of the Small Business Administration. The Council appreciates the participation from diverse business owners and stakeholders from the Baltimore area.

Austin, TX

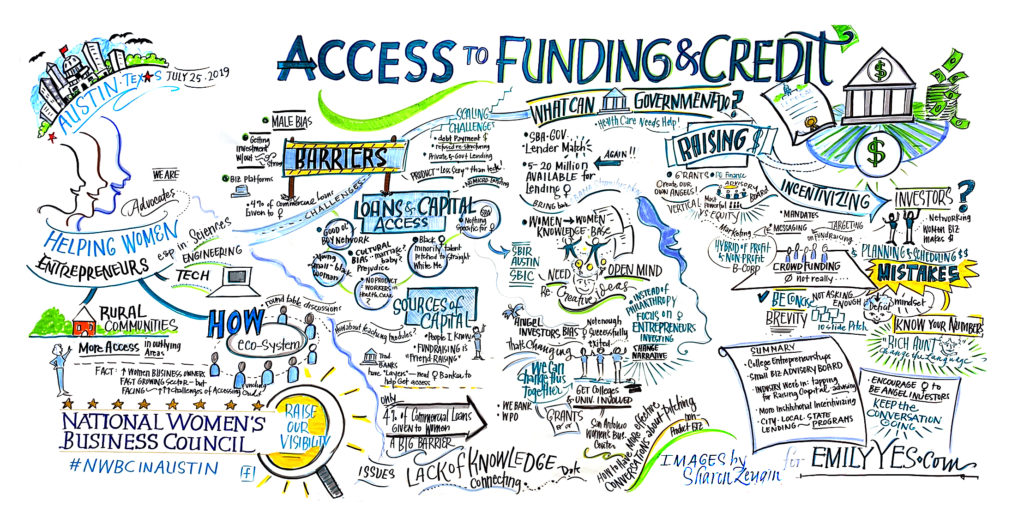

WASHINTON, D.C., July 30, 2019 – As part of its ‘Women in Small Business Roundtable Series,’ the National Women’s Business Council (NWBC) held a roundtable in Austin, Texas, on July 25, 2019, to better understand the specific challenges and opportunities for women’s entrepreneurship by delving into the topic of access to capital, with a specific focus on issues related to credit access and venture capital. Austin has become the start-up and entrepreneurship capital of Texas and is the second-best city in the country in terms of economic clout for women in business according to the 2018 AMEX State of Women-Owned Businesses Report.

The event began with NWBC Chair Liz Sara welcoming the roundtable participants and attendees, including investors, lenders, and various business sectors from technology to aerospace to health. NWBC Council Member Rebecca Contreras, a local of Austin, then prompted the women entrepreneurs to share their experiences seeking funding to start and grow their businesses. Contreras noted that “women only receive 4.4% of small business commercial loans, despite the fact that women pay back their micro loans at a 97% rate of return” and asked the lenders in the room to shed light on this phenomenon. All the participants recognized the difficulties of raising traditional forms of capital. Some recounted being questioned by lenders differently than their male counterparts. One participant shared that while “men can get an investment on an idea, women need to go in with their product already built and show some sales first.”

The importance of mentorship and a support network, often found in other women’s business organizations, was prominent themes around the table. A high-growth business owner and advocate for female entrepreneurs recommended that other female founders assemble their own industry specific advisory committee to assist them in connecting with other founders in their industry. “Don’t be afraid to inconvenience people,” she said. Another business owner, who was initially turned away by a traditional lender, found support from her local chamber of commerce. After building a network within her chamber community, she was able to return to that same lender and acquire capital. She is now nationally recognized for her cupcakes.

NWBC Council Member Vanessa Dawson, CEO of the Vinetta Project, a capital platform that sources, funds, and supports promising female founders, shifted the discussion toward angel investing and venture capital. She noted the Pitchbook statistic that female founders received only 2.2% or $2.88 billion of the total $130 billion in VC funding in 2018.

She asked the roundtable participants to share some of their successes pitching their business ideas as well as some of their pitfalls. One woman founder shared that despite having orders from a high-end retail company, she was initially unsuccessful in acquiring venture capital.

NWBC Chair Sara wrapped up the roundtable discussion and reiterated the Council’s commitment to employ the feedback received as a springboard for the Council’s policy recommendations to Congress, the President, and the Administrator of the Small Business Administration. The Council appreciates the participation from diverse business owners and stakeholders in the Austin area.

For more information about upcoming events, please visit the NWBC website.

###