Although NWBC has indefinitely postponed its signature #LetsTalkBusiness Roundtable Series, which connects the voices of women entrepreneurs and business owners from across the country to policymakers in the Nation’s capital and helps serve as a springboard for the Council’s annual policy recommendations to Congress, the President, and the Administrator of the U.S. Small Business Administration (SBA), NWBC remains focused on carrying out its critical mission. As was reinforced at our first 2020 #LetsTalkBusiness Roundtable last month in San Juan, Puerto Rico, women business owners are key to helping local and national economies recover from disasters as well as grow and thrive.

Check out this dynamic interview with Dolmarie Mendez, Co-Founder and CEO of Abartys Health at NWBC’s #LetsTalkBusiness Roundtable in San Juan, Puerto Rico.

Throughout these past few weeks, I have had the opportunity to represent the National Women’s Business Council (NWBC) at the Kauffman Foundation’s Annual ESHIP Summit in Kansas City, MS, and at the Diana International Impact Day at Babson College in Wellesley, MA. Both convenings provided unparalleled dialogue between entrepreneurs, researchers, educators, investors, and policymakers.

At the Diana Impact Day, I had the great opportunity to moderate the Conference’s Session A: Connecting Research and Practice, with a specific focus on addressing financing for women entrepreneurs. The session was divided into two panels – the first on pipeline issues and the second on implicit bias. Each panel featured an entrepreneurial research expert, an investor, and a woman entrepreneur. Following each panel discussion, I invited conference attendees to discuss some of the perspectives presented, best practices to address any funding challenges identified, and some of their commitments to action.

Despite the significant gains that women entrepreneurs and business owners have made throughout the 30 years of NWBC’s existence, the dialogue between the panelists and the attendees highlighted the significant challenges and barriers that persist for women entrepreneurs seeking to start and grow their businesses. Most conference attendees were aware of the alarmingly low percentage of venture capital funds that are awarded to women entrepreneurs: just 2.7%. That’s just 2.7% of the total $130 billion in venture capital funding awarded in 2018![1]

At the conclusion of the Session, I provided a policy wrap-up for the conference attendees, where I summarized the recurring themes presented in the panel and roundtable discussions. They were: Access, Education, and Challenging the Institutional Bias in Funding.

Overwhelmingly, I heard from the speakers that acquiring venture capital is about access – access to a network of support and access to a network of potential funders and investors. If it’s all about access, it’s easy to understand why that may present more difficult challenges for diverse entrepreneurs who may be in more rural areas for example, or entrepreneurs who may also be first generation Americans.

I also heard that financing women entrepreneurs is about education, both for the entrepreneurs and the investors. It’s about educating women entrepreneurs how to pitch their already-investable ideas to investors. And as entrepreneur Carla Walker-Miller, founder and CEO of Walker-Miller Energy Services, said “it’s about [teaching women entrepreneurs] to eat the NO’s for breakfast.”

Dr. Alicia Robb, Founder and CEO of Next Wave Impact, pointed out that overcoming some of the challenges to funding women entrepreneurs is also about education and awareness related to alternative forms of capital – finding the right kind of capital for the right kind of entrepreneur. As she pointed out, alternative forms of capital may provide more suitable options for some entrepreneurs. This is also supported by NWBC Kiva and Kickstarter case studies, which revealed promising results for women entrepreneurs seeking to fund their business ventures through crowdfunding platforms.

Both Chip Hazard, General Partner at Flybridge Capital Partners & Investment Partner at XFactor Ventures, and Angela Lee, Founder of 37 Angels & CIO and Associate Dean at Columbia Business School, acknowledged the need for the investor community to recognize some of the institutional bias present in traditional funding structures. Overcoming some of these challenges requires venture capitalists and investors to recognize some of their own internal implicit associations with diverse entrepreneurs and unique or different business ideas. The vast majority of investors continue to be men[2], some of whom may find it difficult to understand or relate to a product that they won’t personally be able to use. A recent story I read about an entrepreneur seeking capital for her smart breast pump comes to mind.[3] In that case, she found great success in funding her venture through Kickstarter.

At the conclusion of the Session, I reiterated the Council’s commitment to listen and engage with diverse members of the the larger entrepreneurial ecosystem, and to continue to elevate their voices to policymakers. I am particularly encouraged by the Council’s new slate of recently installed members, who are especially committed to elevating the often unheard or overlooked voices of women entrepreneurs in rural areas and in STEM fields.

I also invited conference attendees to join in on NWBC’s roundtables around the country, to continue to share their research findings with us, and to stay engaged with us by providing comments and feedback on our public meetings and Annual Report to Congress and the President. It is critical to the work of the Council, as advisors to the President, Congress and the Small Business Administration, that we continue to hear from you.

[1] Funding Female Founders 2018

[2] Why women invest 40 percent less than men?

[3] How grown men behave when pitched for VC funding for smart breast pump?

Austin, TX

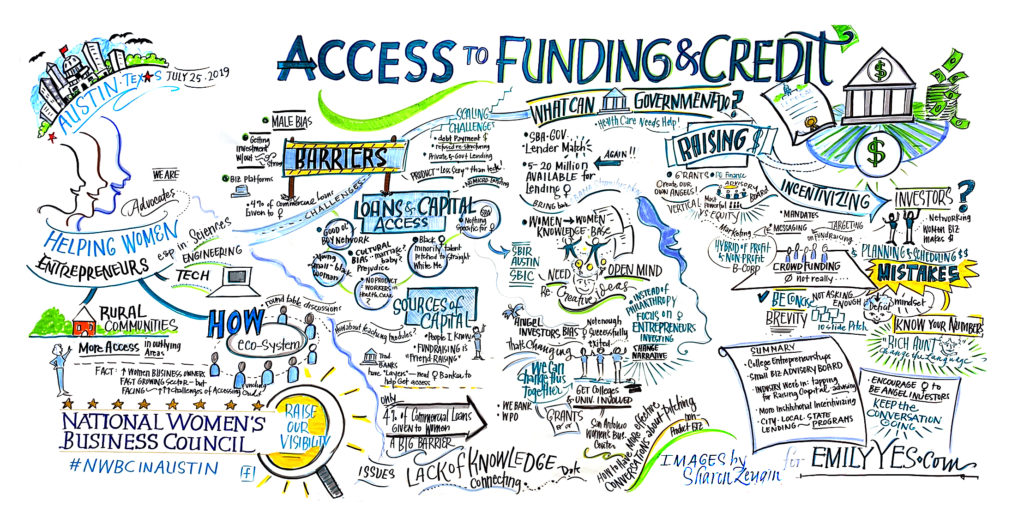

WASHINTON, D.C., July 30, 2019 – As part of its ‘Women in Small Business Roundtable Series,’ the National Women’s Business Council (NWBC) held a roundtable in Austin, Texas, on July 25, 2019, to better understand the specific challenges and opportunities for women’s entrepreneurship by delving into the topic of access to capital, with a specific focus on issues related to credit access and venture capital. Austin has become the start-up and entrepreneurship capital of Texas and is the second-best city in the country in terms of economic clout for women in business according to the 2018 AMEX State of Women-Owned Businesses Report.

The event began with NWBC Chair Liz Sara welcoming the roundtable participants and attendees, including investors, lenders, and various business sectors from technology to aerospace to health. NWBC Council Member Rebecca Contreras, a local of Austin, then prompted the women entrepreneurs to share their experiences seeking funding to start and grow their businesses. Contreras noted that “women only receive 4.4% of small business commercial loans, despite the fact that women pay back their micro loans at a 97% rate of return” and asked the lenders in the room to shed light on this phenomenon. All the participants recognized the difficulties of raising traditional forms of capital. Some recounted being questioned by lenders differently than their male counterparts. One participant shared that while “men can get an investment on an idea, women need to go in with their product already built and show some sales first.”

The importance of mentorship and a support network, often found in other women’s business organizations, was prominent themes around the table. A high-growth business owner and advocate for female entrepreneurs recommended that other female founders assemble their own industry specific advisory committee to assist them in connecting with other founders in their industry. “Don’t be afraid to inconvenience people,” she said. Another business owner, who was initially turned away by a traditional lender, found support from her local chamber of commerce. After building a network within her chamber community, she was able to return to that same lender and acquire capital. She is now nationally recognized for her cupcakes.

NWBC Council Member Vanessa Dawson, CEO of the Vinetta Project, a capital platform that sources, funds, and supports promising female founders, shifted the discussion toward angel investing and venture capital. She noted the Pitchbook statistic that female founders received only 2.2% or $2.88 billion of the total $130 billion in VC funding in 2018.

She asked the roundtable participants to share some of their successes pitching their business ideas as well as some of their pitfalls. One woman founder shared that despite having orders from a high-end retail company, she was initially unsuccessful in acquiring venture capital.

NWBC Chair Sara wrapped up the roundtable discussion and reiterated the Council’s commitment to employ the feedback received as a springboard for the Council’s policy recommendations to Congress, the President, and the Administrator of the Small Business Administration. The Council appreciates the participation from diverse business owners and stakeholders in the Austin area.

For more information about upcoming events, please visit the NWBC website.

###

Marina Del Rey, CA

WASHINTON, D.C., September 30, 2019 – As part of its ‘Women in Small Business Roundtable Series,’ the National Women’s Business Council (NWBC) held a roundtable in Los Angeles, CA on September 17, 2019, to better understand the specific challenges and opportunities for women’s entrepreneurship pertaining to access to capital, with a specific focus on angel investment and venture capital. California’s women owned firms employ more than 1 million people and generate a combined annual revenue of nearly $225.5 billion according to the 2017 AMEX State of Women-Owned Businesses Report.

The event began with NWBC Chair Liz Sara welcoming the roundtable participants and attendees. She noted, “Los Angeles is a very important roundtable stop for the Council. California is home to the greatest number of women-owned businesses in the nation with about 1.55 million, according to estimates in a seventh annual American Express analysis of U.S. Census Bureau data.”

NWBC Council Member Vanessa Dawson, a local of Los Angeles, then prompted the women entrepreneurs to share their experiences seeking funding to start and grow their businesses. Dawson noted that “unfortunately, female founders received only 2.2% or $2.88 billion of the total $130 billion in Venture Capital (VC) funding in 2018” and asked the roundtable participants to shed light on this phenomenon. All the participants recognized the difficulties of raising traditional forms of capital.

One participant, an angel investor, shared that the vast majority of founders in her portfolio were women because she had created an equally accessible platform and not because she had considered gender as a reason to fund. She also highlighted the low number of female investors willing to write the big checks.

Financial assistance was a recurring topic during the discussion. One investment partner lamented that she had never heard of the available Small Business Administration (SBA) loan programs prior to the roundtable and regretted the missed opportunities to connect women founders to those resources. She also encouraged federal agency outreach to the angel community and early stage growth investors. A local SBA representative shared SBA’s community to increase outreach and highlighted SBA’s LenderMatch program, a free online referral tool that connects small businesses with participating SBA-approved lenders.

NWBC Nicole Cober wrapped up the roundtable discussion by highlighting the overarching themes and reiterated the Council’s commitment to employ the feedback received as a springboard for the Council’s policy recommendations to Congress, the President, and the Administrator of the Small Business Administration. The Council appreciates the participation from diverse business owners and stakeholders in the Los Angeles area.

WASHINTON, D.C., March 9, 2020 – As part of its ‘#LetsTalkBusiness Roundtable Series,’ the National Women’s Business Council (NWBC) held its first roundtable of the year in San Juan, Puerto Rico on February 27, 2020, at the Puerto Rico Convention Center, together with the Puerto Rico Federal Affairs Administration (PRFAA). NWBC was joined by the Governor of Puerto Rico, Wanda Vázquez Garced, who delivered remarks on the state of women’s entrepreneurship on the Island.

NWBC Chair Liz Sara greeted the roundtable participants and attendees and thanked Governor Vázquez Garced for welcoming NWBC to the Island. Chair Sara then provided remarks on the importance of improving access to capital and opportunity for women entrepreneurs and business owners in Puerto Rico and across the country.

Governor Vázquez Garced underscored her administration’s commitment to strengthening economic conditions for women, emphasizing that “Puerto Rico is open for business” and that women business owners on the Island are key to helping revitalize and further strengthen the Puerto Rican economy.

Following the Governor’s remarks, Council Member Nicole Cober prompted the participants to share the impact that natural disasters—the 2017 hurricanes and recent earthquakes— have had on their businesses.

One female founder in the freight and transportation industry whose business provides global logistics solutions in Puerto Rico shared an emotional account of the widespread devastation experienced across the Island. “Everyone was at risk. Our whole island was at risk…. But the hurricane [Maria] created an incentive to push Puerto Rico forward.” Her company was in fact one of the first responders, creating a temperature-controlled warehouse to store medication and ensuring that medicine was getting to the most vulnerable—even in the most rural and remote areas of the island.

Another participant, a roofing manufacturer, noted that women business owners on the Island, and Puerto Rican women business owners on the mainland, were instrumental to helping provide immediate emergency services. She shared, “We were up and running just four days after the hurricane and brought together the business community. We visited communities across the Island and formed a ‘business emergency group.’”

Council Member Cober noted how important it is to support healthy ecosystems in the post-recovery phase as women-owned small businesses are instrumental to helping save and ensure the continuity of a stronger Puerto Rican economy. She then directed the discussion to the topic of financial education, asking, “How does Puerto Rico institutionalize financial literacy and education in K-12 grades and at the university, if at all?”

A bed-and-breakfast business owner with businesses in Maryland and Puerto Rico stated, “This is not just a problem in Puerto Rico. This is a nation-wide problem. Entrepreneurs often don’t understand that the extension of business credit is based upon an individual’s personal credit.” She continued, “Most kids today graduate from high school and don’t even know or understand what a credit score is; and although women make 75% of all buying decisions, many don’t often have an understanding of the fundamentals of financial literacy.”

Jennifer Storipan, Executive Director of PRFAA, noted that the Governor “is committed to institutionalizing financial education through an ‘Institute of Financial Education’”. She added that Puerto Rico is exploring best practices by taking an interdisciplinary approach—incorporating financial literacy curriculums across Math and Social Studies academic disciplines.

Yvette T. Collazo, the SBA’s Puerto Rico and US Virgin Islands District Director, noted the fact that all financial institutions, including credit unions, are certified in Puerto Rico. However, a challenge is that credit unions “are set up to provide personal but not commercial loans.” She also recommended to new start-ups that “while you need to think big, you need to start small, and for that reason microlending is key in Puerto Rico.”

District Director Collazo also noted how important STEM businesses were to the economy in Puerto Rico. Last year, the SBIR Road Tour made a pit stop on the Island for the first time in its history. Similarly, the SBA’s Emerging Leaders program was recently brought to Puerto Rico, a telltale sign of the economic and entrepreneurial potential on the Island.

Council Member Barbara Kniff-McCulla noted how the business community in her Iowa hometown chose to invest in STEM education. “In Pella, working with local manufacturers through a public-private partnership, we put in a STEM program in Central College. So, I would recommend that you look to local businesses to put money into your [education] program[s] because these are the businesses that will be hiring these students in the future.” She then asked the business owners to share some of the initial steps they took in looking for capital to start their business.

Another female lender—certified as a Community Development Financial Institution (CDFI) by the U.S. Treasury and certified by the SBA as a 504 Development Company Loan Program—noted that her organization created an ‘entrepreneurs academy’ and added a childcare component for academy participants free of charge.

A National Association of Women Business Owners (NAWBO) Board Member and business owner in the emergency medical services field also noted, “Because of my relationship with NAWBO, I’ve been supported and provided with mentorship. And today, we work with young ladies to provide them guidance and financial literacy.”

A Chicago-based lawyer/entrepreneur also reiterated, “Mentorship is great, but it’s not just mentorship. Women need sponsorship. Don’t just talk to women about how to do it, take her with you and walk her through the door.”

NWBC Council Member Rebecca Hamilton then asked the roundtable participants to share some of the primary drivers and top financial factors informing their decision whether to fund a prospective investment.

The head of an NGO in Puerto Rico stated that when considering funding an enterprise, their organization looks to certain criteria, which include ensuring: 1) there are at least two individuals tied to the project; 2) they have conducted a market study for their product or service; and 3) they commit to completing a curriculum and its required hours. Only after completing the curriculum do they get the funding.

A health tech female CEO also shared a gripping story that spanned from pitching her health tech start-up while five months pregnant to winning ‘Rise of the Rest Competition’ to raising $3 million for her enterprise with local capital. “I went through a whole acceleration process. Today, we are a woman-owned company with twenty-seven employees.” She shared that the road is not easy and that “you just have to get out there” and find opportunities to “expose your companies to Angel Investors.”

Council Member Cober wrapped up the roundtable discussion and reiterated the NWBC’s commitment to employ the feedback received as a springboard for the Council’s policy recommendations to Congress, the President, and the Administrator of the Small Business Administration. The Council appreciates the participation from diverse business owners and stakeholders in Puerto Rico.

For more information about upcoming events, please visit the NWBC website.

Higher Revenues And Greater Optimism: Female-Owned Small Businesses Are Gaining Ground

While the two reports points to great strides for women-owned businesses, Liz Sara, National Women’s Business Council (NWBC) chair, thinks that it also speaks to “some of the major challenges that we’re trying to overcome to make it easier for women.” One major problem that persists: raising capital.

Forbes reports the National Women’s Business Council is collaborating with federal lawmakers to address the issue, by creating an angel investor tax credit that would serve as an incentive.