Executive

Director’s

Message

“Now, more than ever, we must press for the change we know is possible and vital to the success of women business owners and our global economy.”

Thirty-four years ago, existing and aspiring women business owners and their supporters

took a stand. Together, they determined that women entrepreneurs deserved equal access to

entrepreneurial resources, nondiscriminatory funding, and contracting opportunities,

attaining that first milestone with the signing

of H.R. 5050—the Women’s Business Ownership Act—into law. Today, H.R. 5050 continues to

represent the power of our collective voices at work and serves as an important reminder

not only of our shared legacy, but also of the urgent need for new breakthrough ideas and

collaborative energy critical to fighting systemic discrimination and to championing

legislation and tailored programs that support the needs of all U.S. women business

owners.

That is why it is of significant importance that we have prioritized rebuilding the

Council with powerful women who have their ears to the ground and are closest to the

issues impacting entrepreneurs nationwide. We are confident that our Council Members’

insights, as well as the strength and ingenuity of our combined networks,

will further the Council’s goals in the year ahead. This includes influencing policy to

change certain lending criteria that are inherently stacked against women of color,

building a stronger coalition of collaborators working toward gender parity across federal

programs, and ensuring engagement and customized supports for the betterment of diverse

women entrepreneurs in communities across the country. As we continue to navigate the

after-effects of the pandemic, it has become apparent that the work of this Council—the

various meetings, policy roundtables, research, and the sharing of our collective

experiences and deliberations—will continue to build momentum. This is no time to slow

down. In fact, now, more than ever, we must press for the change we know is possible and

vital to the success of women business owners and our global economy.

President Biden’s budgetary commitments to women business owners set the precedence for the work ahead of us. We are encouraged by this bold stance to bolster services for women and other underserved entrepreneurs by expanding current programs and supporting innovative initiatives to foster economic resiliency. I have no doubt that our new Council of power players will continue to seize the opportunity and help define how this commitment connects to women-owned enterprises, as more and more shift from “the pivot” and recovery to growth. It is a privilege to help harness this Council’s expertise and energy, with the support of the NWBC Team, to help bring about meaningful change for today’s women business owners and the next generation of women entrepreneurs.

Executive

Director’s

Message

“Now, more than ever, we must press for the change we know is possible and vital to the success of women business owners and our global economy.”

Thirty-four years ago, existing and aspiring women business owners and their supporters

took a stand. Together, they determined that women entrepreneurs deserved equal access to

entrepreneurial resources, nondiscriminatory funding, and contracting opportunities,

attaining that first milestone with the signing

of H.R. 5050—the Women’s Business Ownership Act—into law. Today, H.R. 5050 continues to

represent the power of our collective voices at work and serves as an important reminder

not only of our shared legacy, but also of the urgent need for new breakthrough ideas and

collaborative energy critical to fighting systemic discrimination and to championing

legislation and tailored programs that support the needs of all U.S. women business

owners.

That is why it is of significant importance that we have prioritized rebuilding the

Council with powerful women who have their ears to the ground and are closest to the

issues impacting entrepreneurs nationwide. We are confident that our Council Members’

insights, as well as the strength and ingenuity of our combined networks,

will further the Council’s goals in the year ahead. This includes influencing policy to

change certain lending criteria that are inherently stacked against women of color,

building a stronger coalition of collaborators working toward gender parity across federal

programs, and ensuring engagement and customized supports for the betterment of diverse

women entrepreneurs in communities across the country. As we continue to navigate the

after-effects of the pandemic, it has become apparent that the work of this Council—the

various meetings, policy roundtables, research, and the sharing of our collective

experiences and deliberations—will continue to build momentum. This is no time to slow

down. In fact, now, more than ever, we must press for the change we know is possible and

vital to the success of women business owners and our global economy.

President Biden’s budgetary commitments to women business owners set the precedence for the work ahead of us. We are encouraged by this bold stance to bolster services for women and other underserved entrepreneurs by expanding current programs and supporting innovative initiatives to foster economic resiliency. I have no doubt that our new Council of power players will continue to seize the opportunity and help define how this commitment connects to women-owned enterprises, as more and more shift from “the pivot” and recovery to growth. It is a privilege to help harness this Council’s expertise and energy, with the support of the NWBC Team, to help bring about meaningful change for today’s women business owners and the next generation of women entrepreneurs.

Table of

Contents

History, Mission

AND STRUCTURE

History, Mission

AND STRUCTURE

History, Mission

AND STRUCTURE

History

The National Women’s Business Council (“NWBC” or “the Council”) was created under Title IV of H.R. 5050: The Women’s Business Ownership Act of 1988, as amended (U.S.C. § 7105, et seq.). H.R. 5050 was authored by Congressman John LaFalce (D-NY) and signed into law by President Ronald Reagan. NWBC operates in accordance with the Federal Advisory Committee Act (FACA).

A landmark piece of legislation, H.R. 5050 also:

Mission

NWBC is an independent, nonpartisan federal advisory committee housed within the U.S. Small Business Administration (SBA). It is made up of 15 volunteers who are all prominent women business owners and leaders of national women’s business organizations. The Council’s core mission is to provide advice and annual policy recommendations to the President, Congress, and the SBA Administrator on issues of importance to women business owners.

NWBC’s statutory obligations include:

STRUCTURE

Fifteen Council Members serve three-year terms:

One Presidentially appointed Chair.

Four small business owners serve from the President’s political party.

Four small business owners serve from parties other than the President’s.

Six women leaders serve from women’s business organizations.

COUNCIL MEMBERS:

Small Business Owners

Maria Rios

President and Chief

Executive

Officer of Nation Waste, Inc.

Selena Rodgers Dickerson

Founder

of SARCOR, LLC

Business Organizations

Jaime Gloshay

Cofounder and

Codirector of Native Women Lead (NWL)

Dr. Shakenna Williams

Executive

Director of the Center for Women’s Entrepreneurial Leadership (CWEL) and Founder

of Black Women’s Enterpreneurial Leadership (BWEL)

Roberta McCullough

Board Chair of

the Association of Women’s Business Centers (AWBC)

Pamela Prince-Easton

President and

Chief Executive officer of Women’s Business Enterprise National Council (WBENC)

By The

NUMBERS

By The

NUMBERS

By The

NUMBERS

By The

NUMBERS

By The

NUMBERS

By The

NUMBERS

INTRODUCTION

The economic landscape for women entrepreneurs is constantly evolving. “By The Numbers” captures the state of affairs during the past year, and what may lie ahead during the next few. The first section, a general overview, is based on research findings from Adji Fatou Diagne, PhD, a research economist with the Center for Economic Studies at the U.S. Census Bureau. She presented these research findings to the Council and the public during NWBC’s May public meeting.

The second section focuses on the dynamics at play in venture capital for women founders, investors, and fund managers, based on the work of Geri Stengel, President of Ventureneer. Her analysis was conducted as part of a report entitled “How Women (and Men) Invest In Startups,” which was produced by Ventureneer and CoreWoman and commissioned by How Women Invest.

INTRODUCTION

The economic landscape for women entrepreneurs is constantly evolving. “By The Numbers” captures the state of affairs during the past year, and what may lie ahead during the next few. The first section, a general overview, is based on research findings from Adji Fatou Diagne, PhD, a research economist with the Center for Economic Studies at the U.S. Census Bureau.She presented these research findings to the Council and the public during NWBC’s May public meeting. The second section focuses on the dynamics at play in venture capital for women founders, investors, and fund managers, based on the work of Geri Stengel, President of Ventureneer. Her analysis was conducted as part of a report entitled “How Women (and Men) Invest In Startups,” whichwas produced by Ventureneer and CoreWoman and commissioned by How Women Invest.

The second section focuses on the dynamics at play in venture capital for women founders, investors, and fund managers, based on the work of Geri Stengel, President of Ventureneer. Her analysis was conducted as part of a report entitled “How Women (and Men) Invest In Startups,” whichwas produced by Ventureneer and CoreWoman and commissioned by How Women Invest.

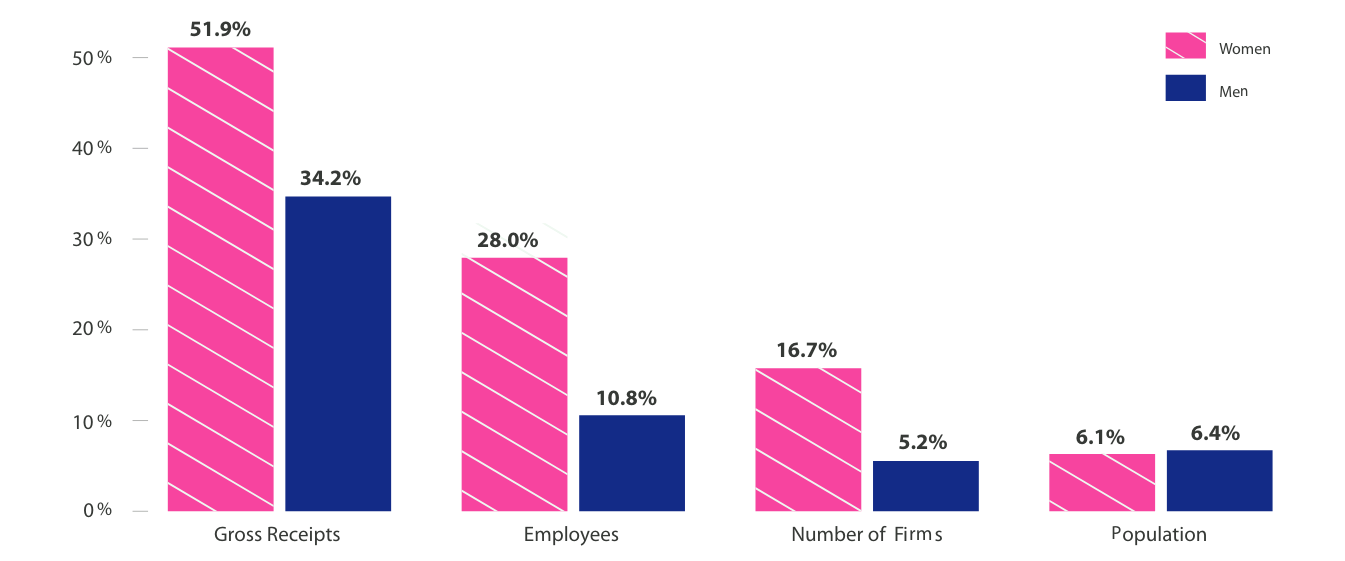

THE STATE OF WOMEN-OWNED BUSINESSES

Most Recent Statistics and Growth

Women contribute substantially to entrepreneurship in the United States. The number of

women-owned

businesses has increased significantly in recent years. In 2019 (latest data available),

there were 5.7 million employer businesses where women accounted for 1.2 million or 20.9%

of these businesses.1 Women-employer firms grew 16.7% between 2012 and 2019

compared to the 5.2% growth rate for men-owned firms during this period (see figure

below). Gross receipts for women-owned employer businesses increased exponentially (51.9%)

between 2012 and 2019 while revenues for men rose 34.2%. Women-owned firms employed 10.8

million workers in 2019 and grew their workforce by 28%, more than double that of

men-owned firms (10.8%) between 2012 and 2019. To put these numbers into perspective, the

adult female population went up 6.1% versus 6.4% for the male adult

population.2

Women-owned nonemployer firms totalled 10.9 million in 2018, a share of 41% of all nonemployer businesses in the U.S. These businesses generated $1.3 trillion in revenue, where women accounted for $299.7 billion of these receipts. In terms of growth, nonemployer firms increased 10.3% and receipts surged 26.1% between 2014-2018 (years data are available).3 There was a rise of 4.2% in total women-owned nonemployer businesses, and revenues expanded 20.1% during this time. These figures compare to 5.1% and 14.4% for men-owned firms.

1 Note: The Census Bureau defines majority women-owned businesses as having more than 50%

of the stock or equity in the business.

2 American Community Survey 1-Year Estimates, 2019.

3 Note: Receipts are in nominal dollars.

Sources: Adela Luque et al. (2019) “Nonemployer Statistics by Demographics (NES-D):

Exploring Longitudinal Consistency and Sub-national Estimates”, CES 19-34; table 16, 2014

estimates U.S. Census Bureau, 2018 Nonemployer Establishment Statistics-Demographics

(NES-D)

Women-Owned Employer Firms vs. Men-Owned Employer Firms Growth Rates

Note: Receipts are in nominal dollars. Population represents the U.S. adult

population.

Sources: U.S. Census Bureau 2012 Survey of Business Owners, U.S. Census Bureau and

National Center for Science and Engineering Statistics, 2020 Annual Business Survey, data

year 2019 American Community Survey1-Year Estimates

Women-owned nonemployer firms totalled 10.9 million in 2018, a share of 41% of all nonemployer businesses in the U.S.

WOMEN-EMPLOYER

FIRMS GREW

16.7%

OF

BETWEEN

2012 AND 2019

TO THE

5.2%

GROWTH RATE FOR

MEN-OWNED FIRMS

Women-Owned Employer Firms vs. Men-Owned Employer Firms Growth Rates

Note: Receipts are in nominal dollars. Population represents the U.S. adult

population.

Sources: U.S. Census Bureau 2012 Survey of Business Owners, U.S. Census Bureau and

National Center for Science and Engineering Statistics, 2020 Annual Business Survey, data

year 2019 American Community Survey1-Year Estimates

Women-owned nonemployer firms totalled 10.9 million in 2018, a share of 41% of all nonemployer businesses in the U.S.

WOMEN-EMPLOYER

FIRMS GREW

16.7%

OF BETWEEN

2012 AND 2019

TO THE

5.2%

GROWTH RATE FOR

MEN-OWNED FIRMS

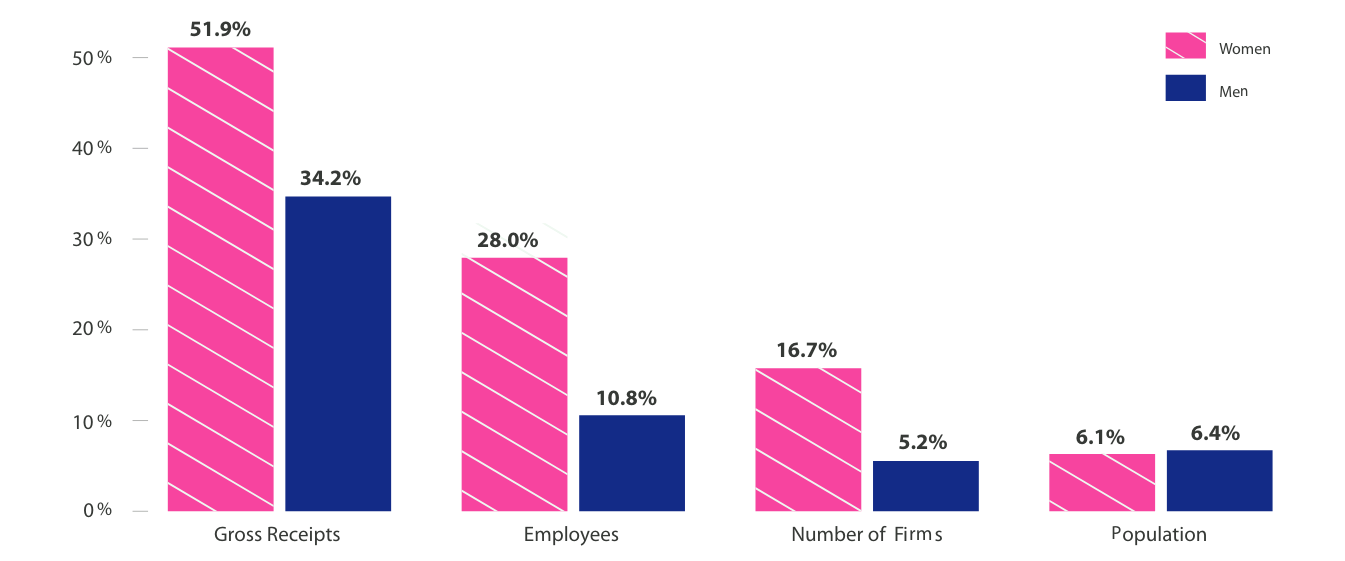

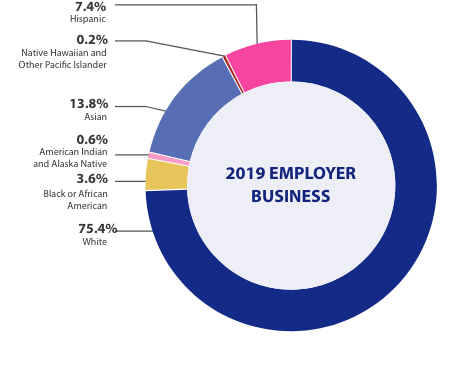

Race and Ethnicity

Among women-owned firms, employer businesses are more likely to be non-Hispanic white- and Asian-Owned, making up 75.4% (911,359) and 13.8% (166,212) of these firms respectively. These shares decline when looking at the combined 2018 employer and nonemployer firms at 64.6% and 7.9%, respectively. On the other hand, Hispanic and Black or African-American women-owned businesses tend to not have paid employees as seen on the right pie chart, boosting the number of employer and nonemployer firms combined to be 1.7 million and 1.5 million or 14.5% and 12.7% versus 7.4% (89,785) and 3.6% (43,696), respectively.

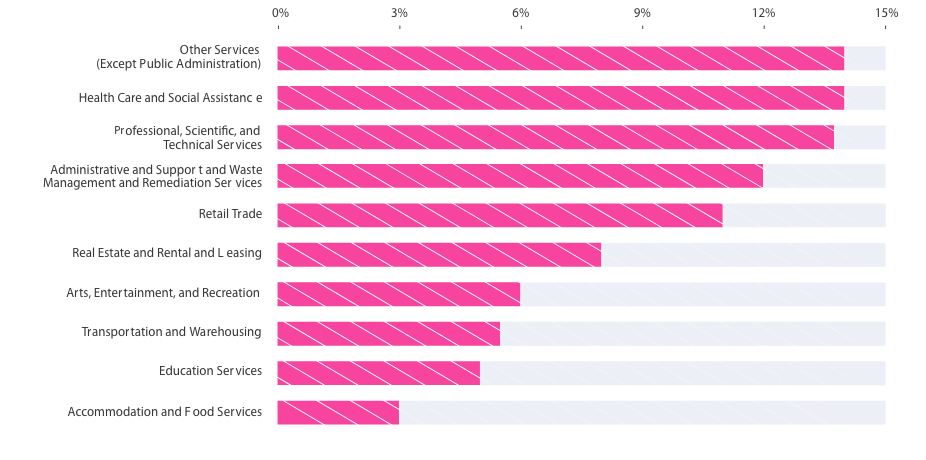

Industry Analysis and the COVID-19 Pandemic

The top ten industries in women-owned businesses are listed on the chart below. It can be observed that the top five sectors of these firms are other services; healthcare and social assistance; professional, scientific, and technical services; retail trade; and administrative and support and waste management and remediation services account for slightly one-third (66.2%) of all women-owned firms. These industry statistics become particularly important when discussing the impact of the pandemic on women’s entrepreneurship. The Department of Labor released a report in April documenting several ways in which women were impacted.

Women were overrepresented in industries that experienced the pandemic’s worst job losses due to industry and occupational segregation.

74.8%

OF HEALTH AND EDUCATION

SERVICE JOBS

78.8%

OF JOBS LOST IN THAT SECTOR DURING THE PANDEMIC 4

Share of Women-Owned Businesses (Top Ten Industries)

Source: U.S. Census Bureau, 2018 Annual Business Survey and Nonemployer Establishment Statistics-Demographics (NES-D)

Industry Analysis and the COVID-19

The top ten industries in women-owned businesses are listed on the chart below. It can be observed that the top five sectors of these firms other services; healthcare and social assistance; professional, scientific, and technical services; retail trade; and administrative and support and waste management and remediation services account for slightly one-third (66.2%) of all women-owned firms. These industry statistics become particularly important when discussing the impact of the pandemic on women’s entrepreneurship. The Department of Labor released a report in April documenting several ways in which women were impacted.

4 “Bearing the Cost: How Overrepresentation in Undervalued Jobs Hurt Women During the Pandemic.” U.S. Department of Labor (2022), https://www.dol.gov/sites/dolgov/files/WB/media/BearingTheCostReport.pdf.

Share of Women-Owned Businesses (Top Ten Industries)

Source: U.S. Census Bureau, 2018 Annual Business Survey and Nonemployer Establishment Statistics-Demographics (NES-D)

Women were overrepresented in industries that experienced the pandemic’s worst job losses due to industry and occupational segregation.

74.8%

OF HEALTH AND EDUCATION

SERVICE JOBS

78.8%

OF JOBS LOST IN THAT SECTOR

DURING THE PANDEMIC 4

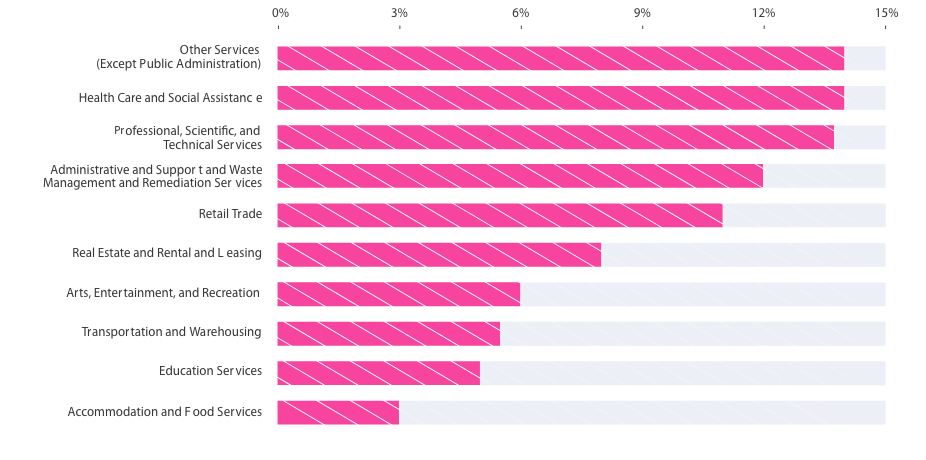

The Imact of the COVID-19 Pandemic on Business Sales

Women-Owned Businesses

Men-Owned Businesses

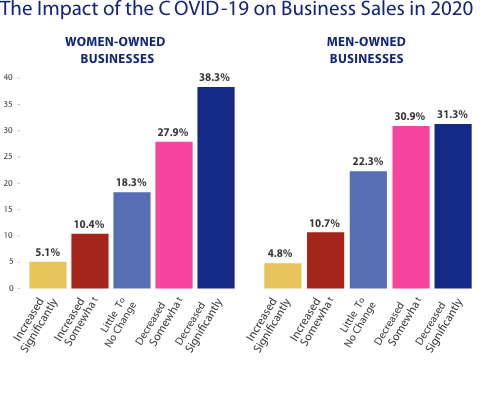

With respect to the pandemic’s impact on businesses, preliminary released statistics from the 2021 Annual Business Survey on the impact of the pandemic also show that 38.3% of women owned businesses said total sales decreased significantly, compared to 31.3% for men-owned businesses. Meanwhile, 18.3% of women-owned firms said there was little to no change in sales vs. 22.3% of men-owned firms.5

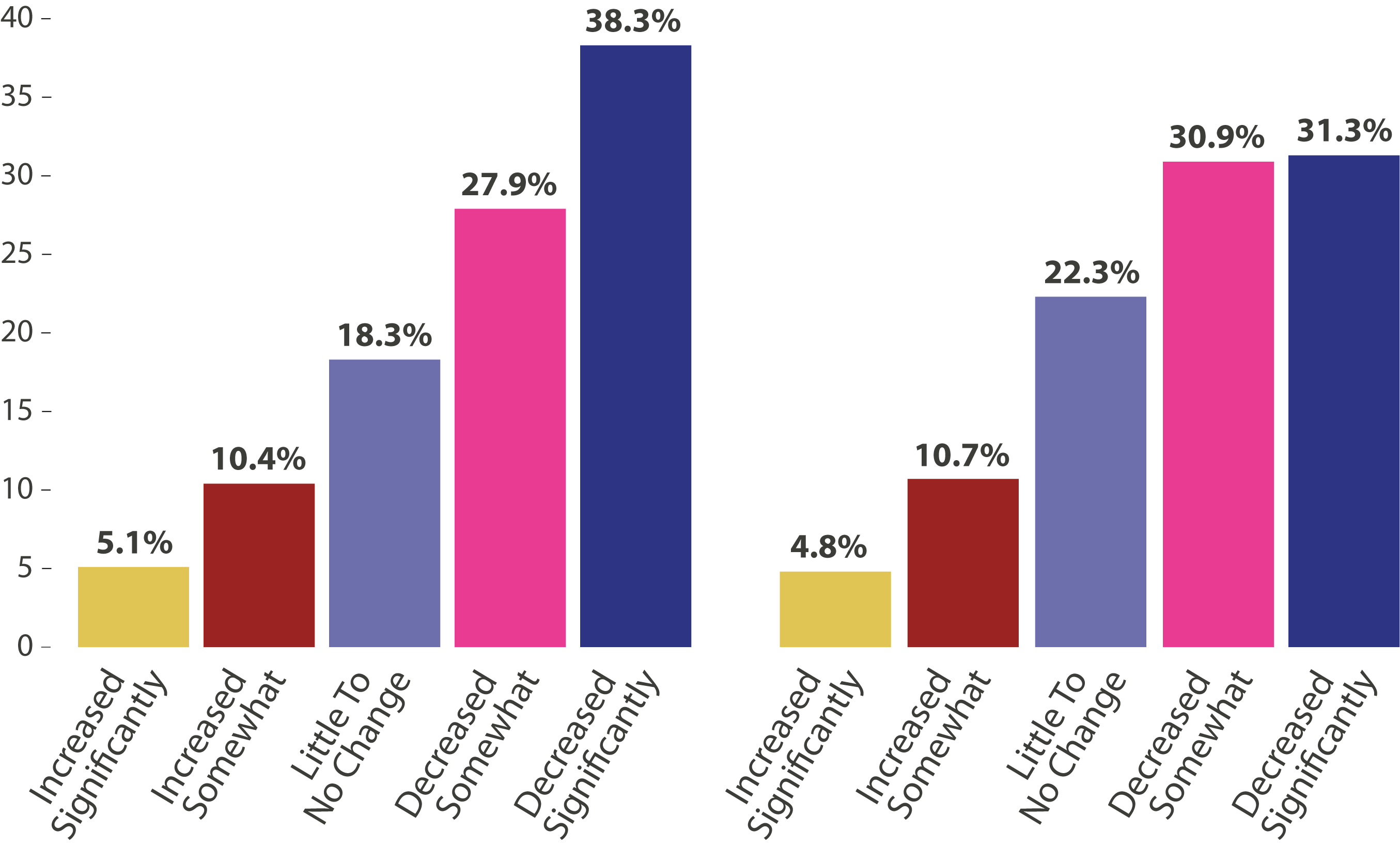

Business’s Purpose for Seeking Financingin 2020 (Excluding Forgivable Loans)

Women-Owned Business

Men-Owned Businesses

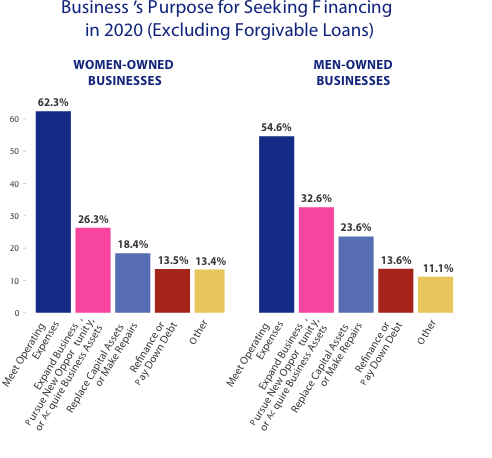

In terms of access to capital, 62.3% of women have sought financing to meet operating expenses vs. 54.6% for men. More men (32.6%) have searched for financing to expand business, pursue new opportunity, or acquire business assets compared to 26.3% of women-owned businesses. These figures are in line with previous research findings on access to capital and women-owned business expansion, which show that women are more reluctant to seek financial capital that could allow them to grow their firms.6

Source: U.S. Census Bureau and National Center for Science and Engineering Statistics,

2021 Annual Business Survey, data year 2020

5 Note: Data are preliminary and will be revised when the final 2021 ABS results are

published. Data shown include only firms classifiable by sex. U.S. Census Bureau and

National Center for Science and Engineering Statistics, 2021 Annual Business Survey, data

year 2020

6 Coleman, Susan. “The role of human and financial capital in the profitability and growth

of women-owned small firms.” Journal of SmallBusiness Management 45.3 (2007): 303-319.

With respect to the pandemic’s impact on businesses, preliminary released statistics from the 2021 Annual Business Survey on the impact of the pandemic also show that 38.3% of women-owned businesses said total sales decreased significantly compared to 31.3% for men-owned businesses. Meanwhile, 18.3% of women-owned firms said there was little to no change in sales vs. 22.3% of men-owned firms.5

In terms of access to capital, 62.3% of women have sought financing to meet operating expenses vs. 54.6% for men. More men (32.6%) have searched for financing to expand business, pursue new opportunity, or acquire business assets compared to 26.3% of women-owned businesses. These figures are in line with previous research findings on access to capital and women-owned business expansion, which show that women are more reluctant to seek financial capital that could allow them to grow their firms.6

Source: U.S. Census Bureau and National Center for Science and Engineering Statistics,

2021 Annual Business Survey, data year 2020

5 Note: Data are preliminary and will be revised when the final 2021 ABS results are

published. Data shown include only firms classifiable by sex. U.S. Census Bureau and

National Center for Science and Engineering Statistics, 2021 Annual Business Survey, data

year 2020

6 Coleman, Susan. “The role of human and financial capital in the profitability and growth

of women-owned small firms.” Journal of SmallBusiness Management 45.3 (2007): 303-319.

How Women (And Men) Invest in Startups

Innovation Drives the Economy Forward

Women are increasingly leading high-growth firms, which frequently require venture capital to scale. In 2021, the number of deals grew to 13,107 for all male-founder teams, 4,215 for teams with at least one female founder, and 1,072 for all-female founder teams.7 Yet only a small share of venture dollars goes to female founders. Startups with at least one female founder received 17.2% of venture capital for the first half of 2022, according to PitchBook. Startups founded solely by women raised only 2.4% of venture capital.8 Two primary factors account for the gap: women are less likely than men to found scalable startups9, and male investors—who manage most of the dollars invested in startups—are less likely to invest in female-founded startups.10 Closing this gap can have significant impacts. In addition to greater innovation, economic growth, and job creation, profitable exits for female founders—an IPO or acquisition by another company—will help narrow the gender wealth gap.11

Investment Builds Opportunity

Another way to look at this problem is through the lens of investors themselves. Investing in startups asan asset class for high-net-worth individuals (HNWI) is in its nascent stage—only a miniscule percentage of people who can invest do. If investing in startups becomes more accessible to HNWI, particularly women, it has the potential to become a major source of capital for women and Black, Indigenous, and people of color (BIPOC) founders, and the venture funds that invest in them. By leveraging the power of women’s wealth and passion for social responsibility, a more robust, inclusive economy can be created.

*Barber M. Brad, and Terrance Odean. 2001. “BOYS WILL BE BOYS: GENDER, OVERCONFIDENCE, AND COMMON STOCK INVESTMENT,” Quarterly Journal of Economics, Volume 116, Issue 1, February 2001, Pages 261–292. https://faculty.haas.berkeley.edu/odean/papers/gender/boyswillbeboys.pdf.

7 2022. “The Q2 2022 PitchBook NVCA Venture Monitor,” PitchBook, July 2022.

https://pitchbook.com/news/reports/q2-2022-pitchbook-nvca-venture-monitor.

8 IBID

9 2016. “Kauffman Compilation: Research on Gender and Entrepreneurship, Kauffman

Foundation,” August 2016. https://www.kauffman.org/wp-content/uploads/2019/12/gender_compilation_83016.pdf.

10 Brush, Candida G., Patricia G. Greene, Lakshmi Balachandra, and Amy E. Davis. 2014.

“Diana Report: Women Entrepreneurs 2014: Bridging the Gender Gap in Venture Capital,”

Arthur M. Blank Center for Entrepreneurship Babson College, 2014. https://www.babson.edu/womens-leadership-institute/diana-international-research-institute/research/diana-project/.

11 Chang, Mariko. 2015. “Women and Wealth: Insight for Grantmakers,” Asset Funders

Network, 2015. https://static1.squarespace.com/static5c50b84131d4df5265e7392d/t/5c54781a8165f5b8546f8a34/1549039642955/AFN_Women_and_Wealth_Brief_2015.pdf.

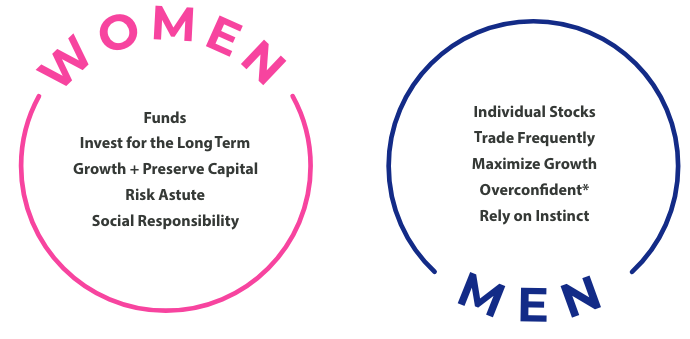

For this goal to become reality, it must be understood that men and women invest differently. For example:

![]() Women offer immense opportunities for wealth management

firms. Women are more likely to rely on their financial advisors’ input than men; men are

more likely to manage their portfolios themselves compared to women.

Women offer immense opportunities for wealth management

firms. Women are more likely to rely on their financial advisors’ input than men; men are

more likely to manage their portfolios themselves compared to women.

Women, Men, and Wealth Management

![]() Wealthy women are sophisticated investors. Women are

much more likely than men to mitigate investment risk by investing in startups to diversify

their portfolios.

Wealthy women are sophisticated investors. Women are

much more likely than men to mitigate investment risk by investing in startups to diversify

their portfolios.

Mitigate Investment Risk by Investing in Startups

![]() Women want to do well by doing good. Women are more

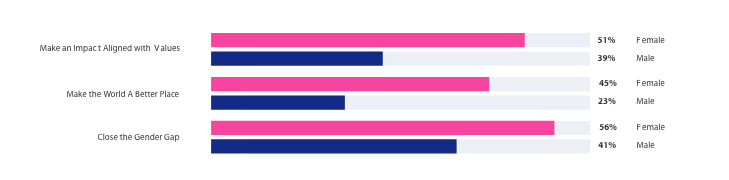

likely than men to invest in startups as a way to make an impact aligned with their values,

to make the world a better place, and to close the gender gap.

Women want to do well by doing good. Women are more

likely than men to invest in startups as a way to make an impact aligned with their values,

to make the world a better place, and to close the gender gap.

Values-Based Investing: Why Do Women and Men Invest in Startups?

These tendencies make women prime prospects to invest in small, emerging, and diverse managed funds. It is also worth noting that the market is growing: Women are poised to inherit a large share of the $30 trillion that will be passed down from Baby Boomers and older generations.12

12 Baghai, Pooneh, Olivia Howard, Lakshmi Prakash, and Jill Zucker. 2020. “Women as the

next wave of growth in US wealth management,” McKinsey & Company, July 29,

2020. https://www.mckinsey.com/industries/financial-services/our-insights/women-as-the-next-wave-of-growth-in-us-wealth-management.

Obstacles to Funding Female VCs and Founders

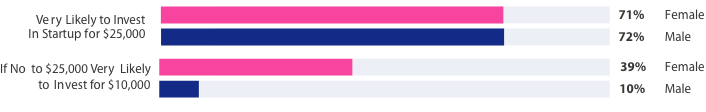

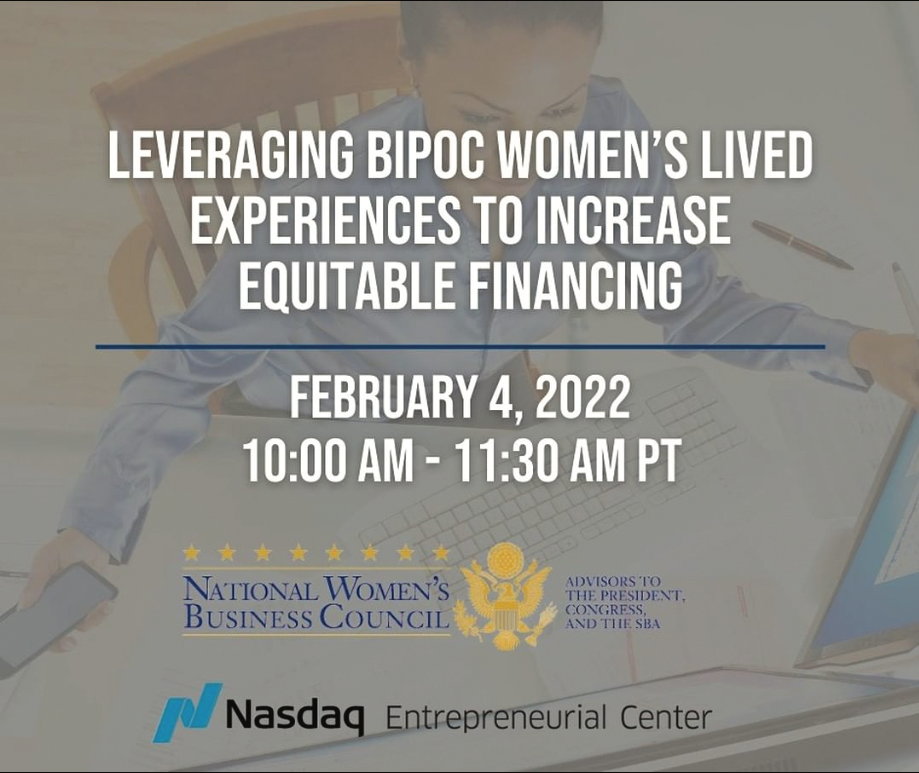

Female venture fund managers and startup founders have a harder time than their male counterparts raising capital from institutional investors and, as a result, they rely more on HNWI—also known as accredited investors, the term the U.S. Securities and Exchange Commission (SEC) uses. To tap into the accredited investor pool of capital, five obstacles to investment need to be overcome.

High investment requirement by most venture funds excludes most accredited

investors:

The minimum check sizes that most venture funds require are too high to attract most

wealthy women. Nearly three-quarters of both male and female investors would write a

check for $25,000 to invest in startups. For those who said “no, they wouldn’t invest

for $25,000,” 39% of women and 10% of men said they would write a check for $10,000.

Invest in Startups If Check Size Is $25,000 or $10,000

Most women don’t have time to do due diligence: There is a lack of research coverage of startups and small, emerging, and diverse managed funds, making it more important that investors do due diligence or find credible trustworthy sources who have. The time it takes to conduct due diligence on startups and the venture funds that invest in them is time-consuming, and a higher share of women compared to men do not have the time to do it.

No Time to Conduct Due Diligence?

Women had concerns about the time it takes to profit from startup investments: The illiquid nature of the investment means in general money is tied up for five to seven years for direct investments in startups, and ten years for venture funds. Since women take the long view on investing, they are less concerned than men. Still, a substantial minority of women are concerned about locking up their investments for a long period.

Concerned About the Time It Takes to Profit from Startup Investment?

Lack of a track record in VC: The lack of performance data can make raising capital for a first, second, or even third venture fund more difficult. It can take five to seven years before data is available on an emerging manager’s investment thesis—the strategy by which a venture capital fund makes money for the fund investors.13

Investing in startups is risky: A substantial minority of women (41%) indicated investing in startups is risky. Interestingly, they were less likely than men (54%) to indicate investing in startups as risky. Women are risk-aware investors.14

Resistances to Be Overcome in Investing in Startups

Investment Today, Returns Tomorrow

The World Economic Forum has estimated that it will take at least 150 years to close the

economic gender gap.15 Directly investing in women innovators through venture

funds is one promising avenue for bridging this divide. In order to make this progress,

women founders must receive funding, women-led VC firms must raise capital, and women

investors must be empowered to invest. According to Boston Consulting Group, when women get

funding, they generate over twice as much in revenue per dollar invested as their male

counterparts and generate 10% more revenue over five years.16 And when women are

in the position to make decisions, they are twice as likely to invest in startups with at

least one female founder and more than three times as likely to invest in startups with

female CEOs.17 Strategic policy changes today will undoubtedly yield robust

returns for investors and the national and global economy.

13 Bogoslaw, David. 2022. “Women-led VCs hit milestone but still face significant

fundraising challenges,” Venture Capital Journal, May 5, 2022. https://www.venturecapitaljournal.com/women-led-vcs-hit-milestone-but-still-face-significant-fundraising-challenges/.

14

Railey, Meghan. 2022. “If female investors have any weakness, it’s their mistaken belief

that they’re not good investors,” CNBC.com, April 11, 2022. https://www.cnbc.com/2022/04/11/op-ed-heres-why-women-are-better-investors-than-men.html#:~:text=However%2C%20while%20many%20may%20think,2021%20Women%20and%20Investing%20Study.

15

2021. “Gender Parity Accelerators,” World Economic Forum, September 2021. https://www.weforum.org/projects/gender-parity-accelerators.

16

RAbouzahr, Katie, Matt Krentz, John Harthorne, and Frances Brooks Taplett, 2018. “Why

Women-Owned Startups Are a Better Bet,” Boston Consulting Group, June 6, 2018. https://www.bcg.com/publications/2018/why-women-owned-startups-are-better-bet.

17

2019. “All Raise Report on Venture Financing in Female-Founded Startups Shows Progress, Yet

Continued Gender Inequity,” Pitchbook, November 12, 2019. https://pitchbook.com/media/press-releases/pitchbook-all-raise-report-on-venture-financing-in-female-founded-startups-shows-progress-yet-continued-genderinequity.

Investment Today, Returns Tomorrow

The World Economic Forum has

estimated that it will take at least 150 years to close the economic gender gap.15 Directly

investing in women innovators through venture funds is one promising avenue for bridging

this divide. In order to make this progress though, women founders must receive funding,

women-led VC firms must raise capital, and women investors must be empowered to invest.

According to Boston Consulting Group, when women get funding, they generate over twice as

much in revenue per dollar invested as their male counterparts, and generate 10% more

revenue over five years.16 And when women are in the position to make decisions, they are

twice as likely to invest in startups with at least one female founder and more than three

times as likely to invest in startups with female CEOs.17 Strategic policy changes today

will undoubtedly yield robust returns for investors and the national and global economy.

13 Bogoslaw, David. 2022. “Women-led VCs hit milestone but still face significant

fundraising challenges,” Venture Capital Journal, May 5, 2022. https://www.venturecapitaljournal.com/women-led-vcs-hit-milestone-but-still-face-significant-fundraising-challenges/.

14

Railey, Meghan. 2022. “If female investors have any weakness, it’s their mistaken belief

that they’re not good investors,” CNBC.com, April 11, 2022. https://www.cnbc.com/2022/04/11/op-ed-heres-why-women-are-better-investors-than-men.html#:~:text=However%2C%20while%20many%20may%20think,2021%20Women%20and%20Investing%20Study.

15

2021. “Gender Parity Accelerators,” World Economic Forum, September 2021. https://www.weforum.org/projects/gender-parity-accelerators.

16

RAbouzahr, Katie, Matt Krentz, John Harthorne, and Frances Brooks Taplett, 2018. “Why

Women-Owned Startups Are a Better Bet,” Boston Consulting Group, June 6, 2018. https://www.bcg.com/publications/2018/why-women-owned-startups-are-better-bet.

17

2019. “All Raise Report on Venture Financing in Female-Founded Startups Shows Progress, Yet

Continued Gender Inequity,” Pitchbook, November 12, 2019. https://pitchbook.com/media/press-releases/pitchbook-all-raise-report-on-venture-financing-in-female-founded-startups-shows-progress-yet-continued-genderinequity.

Engagement

Highlights

Engagement

Highlights

Engagement

Highlights

October

NATIONAL WOMEN’S SMALL BUSINESS MONTH

![]() In celebration of National Women’s Small

Business Month, @NWBC recognized all the small

women-owned businesses that continued to strengthen our communities and drive our

economy.

In celebration of National Women’s Small

Business Month, @NWBC recognized all the small

women-owned businesses that continued to strengthen our communities and drive our

economy.

#womenentrepreneurs #womeninbusinesses

NWBC celebrated and recognized

women-owned

small businesses and the inspiring entrepreneurs who lead them.

October 25, 2021

PUBLIC MEETING AND

33-YEAR ANNIVERSARY

The first public meeting of the 2022 fiscal year highlighted achievements from the previous year and provided updates on NWBC initiatives and policy development. Each of the Council’s subcommittees—Rural Women’s Entrepreneurship, Women in STEM, and Access to Capital & Opportunity—presented their priorities and projects before the full body and the public.

NWBC celebrated 33 years in service on October 25! Since the passage of H.R. 5050: Women’s Business Ownership Act of 1988, the Council has worked diligently to represent the interests of women business owners through recommendations to the White House, Congress, and the SBA Administrator.

February 4, 2022

Roundtable on Leveraging BIPOC Women’s Lived Experiences to Increase Equitable Financing

NWBC’s Council Members held a roundtable in collaboration with the Nasdaq Entrepreneurial Center on equitable financing. On February 4, 2022, they convened entrepreneurs, resource partners, and other key stakeholders to discuss the issues BIPOC women entrepreneurs and founders continue to face when attempting to access equitable financing opportunities to fund a new or growing business.

March 16, 2022

USPTO WOMEN’S ENTREPRENEURSHIP SYMPOSIUM

NWBC Executive Director Tené Dolphin lent her voice to a conversation hosted by the U.S. Patent and Trademark Office (USPTO) on trends and opportunities during the office’s Women’s Entrepreneurship Symposium.

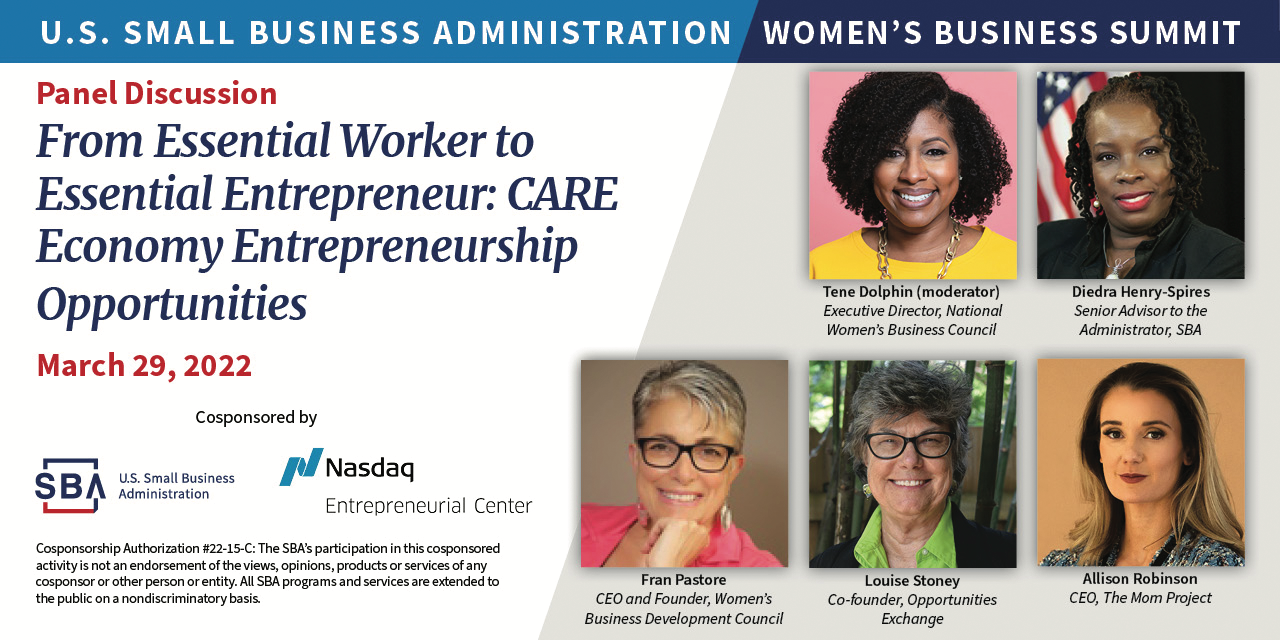

March 28-30, 2022

SBA WOMEN’S BUSINESS SUMMIT

SBA capped off Women’s History Month by holding the inaugural Women’s Business Summit from March 28 to 30. Familiar faces from NWBC, including Council Members Jaime Gloshay and Maria Rios. as well as Executive Director Tené Dolphin, played a key role across numerous panels.

May 3, 2022

Public Meeting

On May 3, NWBC held its second public meeting of the fiscal year. The meeting gave Council Members and the public the opportunity to hear directly from experts and women’s business organizations about issues that matter most to women entrepreneurs. It also gave NWBC the chance to welcome three new Council Members: Roberta McCullough, Jaime Gloshay, and Dr. Shakenna Williams.

May 9, 2022

NWBC PAID FAMILY AND MEDICAL LEAVE (PFML) ROUNDTABLE

On May 9, 2022, NWBC convened women business owners, subject matter experts, government officials, and other key stakeholders to delve into paid family and medical leave (PFML). This discussion focused on how the lack of equitable access to PFML may create barriers to women’s entrepreneurship.

June 28, 2022

Women Rule Panel

Executive Director Tené Dolphin participated on a panel hosted by Politico on June 28, 2022. The event was focused on how women business owners can be prepared for the ever-changing economic landscape based on current events and changes.

July 2, 2022

E-SUITE PANEL AT ESSENCE FEST

Council Member Selena Rodgers Dickerson was invited to be on the Essence Fest 2022 E-Suite Women’s Empowerment Session panel. The six panelists focused on how Black women-owned businesses can expand their reach and access in entrepreneurship.

August 1, 2022

GOVEXEC DAILY PODCAST

Council Member Pamela Prince-Eason appeared on the GovExec Daily podcast to discuss how the pandemic and current economic climate have impacted women. She deftly leveraged her experiences on the Council and as chief executive officer/president of the Women’s Business Enterprise National Council to paint a picture of the current state-of-play facing women entrepreneurs and what may lie ahead.

September 14, 2022

NWBC PUBLIC MEETING

On September 14, 2022, the National Women’s Business Council held a virtual public meeting via Zoom from 12:30 to 2:30 p.m. eastern daylight time. The meeting gave Council Members the opportunity to recap engagements from the past year and deliberate policy recommendations before a public audience.

Quick Reference

ANNUAL POLICY RECOMMENDATIONS

Quick Reference

Quick Reference

ANNUAL POLICY

RECOMMENDATIONS

Quick Reference

Quick Reference

ANNUAL POLICY

RECOMMENDATIONS

ACCCESS TO CAPITAL & OPPORTUNITY

Showcase the Policy “Wins” for Women in Business and Work Toward Systemic Change

But First, Just Fund Her: Create a Financing Bridge to a “Capital Stack” and Promote WOSB Growth

Define “Microbusiness” and Reconsider Debt Relief Options for Micro- and Small Women-Owned Enterprises Impacted by Global Disruptions

Advance and Grow a Community of Women Investing in Women-Owned Businesses

Continue to Strengthen and Work Toward Parity for the WOSB/EDWOSB Federal Contracting Program

Fund, Expand, and Tailor Federal Financial Capability Resources for Women Small Business Owners

Provide Additional Relief for WOSBs Impacted by Ongoing Supply Chain Disruptions and Workforce Availability Issues

WOMEN IN STEM

Women In Academic Innovation

High Yield and High Growth Fields with Low Levels of Women-Owned Business Representation

The STEM Pipeline

RURAL WOMEN’S ENTREPRENEURSHIP

Persistent Barriers to Rural Women’s Entrepreneurship: Lack of Affordable Child Care and Equitable Paid Family and Medical Leave (PFML)

Gain Fresh Insights on Rural Ecosystems: Workforce Development Issues, Local Governance, and Capacity Issues Impacting Rural and Tribal Women Entrepreneurs

Empower Rural Women Entrepreneurs to Thrive in Tomorrow's Global Economy, Today

Enhance Federal Support and Coordinated, Accessible Resources for Rural Women Entrepreneurs

Down to The Roots: Leverage Community-Based Supports to Bolster Rural Women Entrepreneurs

Policy

Recommendations

Policy

Recommendations

Policy

Recommendations

Policy Recommendation

ACCESS TO CAPITAL AND OPPORTUNITY

Showcase the Policy “Wins” for Women in Business and Work Toward Systemic Change

Women are an economic force influencing U.S. and global markets.

$10 TRILLION

OF TOTAL U.S. HOUSEHOLD FINANCIAL ASSETS1

80%

OR MORE OF CONSUMER SPENDING2

$10 TRILLION

OF TOTAL U.S. HOUSEHOLD FINANCIAL ASSETS1

80%

OR MORE OF CONSUMER SPENDING2

Moreover, women business owners in the U.S. constitute about 41percent (10.9 million) of businesses without paid employees and 19.9 percent (1.1 million) of employer-based businesses, employing an estimated 10.1 million workers. These women-owned employer-based businesses also reportedly accumulated $1.8 trillion in receipts in 2019, just prior to the onset of the global pandemic. Despite their commanding presence in the marketplace and their tremendous economic value, persistent challenges to women’s entrepreneurship, predating COVID-19, remain. Whether attempting to access capital, tailored entrepreneurial development resources, meaningful and legitimate mentorship experiences, or federal contracting opportunities, women business owners continue to share with this Council their own lived experiences and the urgent need for impactful policy change, as well as increased information and heightened awareness of the policy wins helping advance women’s business enterprise.

Tackling these historical inequities is now a topic that is front and center of a national conversation. Notably, the White House Gender Policy Council (GPC) established in March 2021 also recently developed “the first-ever National Strategy on Gender Equity and Equality [which seeks to] advance equal rights and opportunity” for more women. The Council remains encouraged by the establishment and work of the GPC. NWBC agrees that prioritizing women, minority, and other economically disadvantaged entrepreneurs’ access to federal programs and financing constitutes a critical first step to eradicating gender and racial disparities with respect to providing entrepreneurial supports and fair access to financing and business opportunities. The White House, and particularly the GPC, is uniquely positioned to help elevate recent “policy wins” and newly enhanced resources for women in business.

Policy Recommendation

But First, Just Fund Her: Create a Financing Bridge to a “Capital Stack” and Promote WOSB Growth

On February 4, 2022, the NWBC held an “Access to Capital & Opportunity” policy roundtable together with the Nasdaq Entrepreneurial Center (NEC). This policy roundtable convened women business owners, government officials, resource partners, and other key stakeholders to address the ongoing challenges BIPOC (Black, Indigenous, People of Color) women entrepreneurs face when attempting to access fair financing opportunities to fund a startup or scale a growing business. 5Roundtable participants also underscored the need for systemic change rather than focusing on overtraining or in some way fixing women entrepreneurs.

Roundtable participants also underscored the need for systemic change rather than focusing on overtraining or in some way fixing women entrepreneurs. These findings align with much of the research and recent available data on this topic. For instance, while women entrepreneurs generally present a lower risk6 and deliver higher returns7, they often face more discouragement from applying for loans8. In fact, recent data indicate that women typically receive lower loan amounts than men for a variety of reasons but are “charged slightly higher interest rates.”9 Noting this important feedback, any future or prospective SBA lending program should not include any future training prerequisites to financing or loan eligibility.

With respect to investments, as highlighted in the roundtable key takeaways above, “women of color founders account for only [about] 0.6 percent of all VC funding.”10 Given the current landscape, particularly for women entrepreneurs of color, exploring alternative lending criteria which takes into consideration these business owners’ lived experiences and their potential for success is critically important. Thus, reconsideration of lending criteria and even more affordable financing and flexible repayment options would better support and fuel the growth of both rising and scaling women-owned businesses.

Policy Recommendation

Define “Microbusiness” and Reconsider Debt Relief Options for Micro- and Small Women-Owned Enterprises Impacted by Global Disruptions

During NWBC’s May 2022 public meeting, several national women’s business organizations shared information about their programmatic and policy priorities. For example, Karen Bennetts, Chair-Elect for the National Association of Women Business Owners (NAWBO) shared that “addressing the needs of ‘microbusinesses’” is critical and discussed the need to define and codify the term “microbusiness” for use by all federal agencies. She explained that differentiating “microbusiness” from “small business” is critical to helping more women entrepreneurs access capital and procurement opportunities. During subsequent NWBC “Access to Capital and Opportunity” subcommittee meetings, Council Members agreed this was an important distinction to raise before the full Council.

Subcommittee discussions also centered on other key factors that have impacted women business owners’ ability to successfully access pandemic relief funding, as well as financing for growth in the years leading up to and following the onset of COVID-19. Both Council Members Selena Rodgers Dickerson and Pamela Prince-Eason discussed the negative ramifications of unfair practices on women’s entrepreneurship in the processing of payments as well as predatory lending practices. Council Member Jaime Gloshay also doubled down on the problem of predatory lending and noted the importance of challenging some underwriting requirements, as well as considering “relationship lending” program models. She also noted that it is important to address both gender and racial discrimination and shared that in Native communities, predatory lending is a big problem and most Native Women business owners tend to self-fund.12

Notably, a recent study co-authored by a Cleveland Fed researcher found that “compared to small businesses owned by men, those owned by women faced more operational and financial challenges and were less likely to receive financing.”13 And, “those owned by Black women, faced more financial and operational challenges during the pandemic and were less likely to receive financing.”14 Women’s lack of access to pandemic relief certainly came to the national forefront during the first tranche of the Paycheck Protection Program (PPP).15 By some accounts, “the discrepancy of average loan amounts between male and female owners [was] even higher than the data suggests for the first time period PPP loans were given.” Moreover, longstanding inequities such as the high cost of capital for many women and minorities has significantly impaired their ability to grow and scale, and thus served as yet another barrier to buildinggenerational wealth via a successful business and strategic exit.17

However, Council Members also remained focused on how to better support women entrepreneurs who successfully accessed relief or other forms of financing prior to, or during the pandemic, and may still be struggling. Remarkably, according to 2021 Goldman Sachs data, about 40 percent of small business owners expressed worry that “the debt they … accumulated during the Covid-19 pandemic … [would] hinder their ability to recover. Even more Black owners (55 percent) [expressed] this concern.18 This data also indicates that just last year, “[n]early 60 percent of Black women small business owners and almost half of women owners overall continue[d] to struggle financially due to the pandemic.”19

Initial steps to help alleviate these financial worries could include defining “microbusinesses” to distinguish these enterprises from small businesses, gleaning learnings from the PPP debt relief model to better inform and potentially expand debt relief options across other SBA lending programs, and continuing to prioritize the needs of women business owners, including those operating in industries with unique workforce retention and scale-up challenges, such as in the care economy.

Congress should develop and provide a uniform definition for a microbusiness. Additionally, Congress and SBA should consider further expansion of debt relief options for certain 7(a), 504, and microloan borrowers, and continue prioritizing the needs of economically disadvantaged micro-and small business borrowers in industries with significant participation by women, particularly those severely impacted by pandemic-related global supply chain issues or other major global economic disruptions.

Policy Recommendation

Advance and Grow a Community of Women Investing in Women-Owned Businesses

During NWBC’s second “Access to Capital and Opportunity” subcommittee meeting, Council Members heard from Julie Castro Abrams, CEO and Chair of How Women Lead and Founder of How Women Invest. She presented on the current state of women-led venture capital (VC) firms and the need to update the current venture ecosystem to better support minority- and women-led VC firms, given that these tend to make more investments in women-owned startup businesses. Notably, some of these women-owned startups are doing the important work of bringing to market products and services for unmet demands (e.g., health tech and “fem tech”).20

As featured in this annual report’s “By the Numbers” data section, women are increasingly

leading promising high-growth firms, which require significant investmes to scale. And while

there has been a slight investment uptick in women-owned firms in recent years, only a small

share of venture dollars goes to female founders today.21 In fact, according to

Pitchbook, “startups with at least one female founder received 17.2% of venture capital for

the first half of 2022 … [while] startups founded solely by women raised only 2.4% of

venture capital.”22 Two main explanations given for such low level investments in

women-owned businesses are:

1) women are less likely than men to found scalable startups23 and 2) male

investors are less likely to invest in female-founded startups.24

However, recent research findings suggest that supporting VC firms which closely align ntwith high-net-worth women and their priorities, taking into consideration how they invest, would likely incentivize new investments in women-owned firms. “Women want to do well by doing good. Women are more likely than men (51% vs 39%) to invest in startups as a way to make an impact aligned with their values, to make the world a better place (45% vs 23%) and to close the gender gap (56% vs 41%).”25 As such, increased support for women-led VC firms would likely help to draw new female investors, narrow the gender wealth gap,26 help bring about positive social impact, and further catalyze innovation and a national post-pandemic economic recovery.

Council Members expressed their intention to further study the issue and viable policy solutions during the next fiscal year. In the interim, NWBC believes Congressional hearings on this topic would be beneficial, as well as establishing grants to help boost recently established VC firms, particularly those with under $50 million and with less than three years of operation, many of which are led by women and minorities.

Also notable, separate and apart from the topic of how to best support women-led VC firms,

at the time of the writing of this report SBA Administrator Isabella Casillas Guzman

“announced the Federal Register publication of SBA-proposed reforms to the Small

Business Investment Company (“SBIC”) program designed to reduce financial barriers and

increase access and diversity in the U.S. small business investment

ecosystem … The proposed rule, SBIC Investment Diversification and Growth, seeks to address

structural aspects of the SBIC program which have historically limited the flow of SBIC

regulatory capital to small businesses and startups not adequately served by private

investors alone.”

For example, one of the proposed reforms is to:

Policy Recommendation

Continue to Strengthen and Work Toward Parity for the WOSB/EDWOSB Federal Contracting Program

Since the 1950s, “Congress has used its broad authority to impose requirements on the federal procurement process to help small businesses receive a fair proportion of federal contracts and subcontracts, primarily through the establishment of federal procurement goals and various contracting preferences.”28These preferences include restricted competitions known as set asides and sole source awards.29

The SBA’s WOSB Federal Contracting Program is just one of those programs. The federal government’s goal is to award at least five percent of all federal contracting dollars to women-owned small businesses each year.30 This is to be accomplished via set asides and sole source awards, but this goal has only been met twice since it was first authorized in 1994 and implemented in 2011. However, as explained in a July 2022 Congressional Research Service report titled SBA Women-Owned Small Business Federal Contracting Program, “[m]ost of the federal contracts awarded to WOSBs are awarded in full and open competition with other firms or with another small business preference, such as an 8(a) or HUBZone program preference. Relatively few federal contracts are awarded through the WOSB program.” 31

Council Members serving on this “Access to Capital and Opportunity” policy subcommittee agree and have repeatedly expressed concern that in addition to federal agencies not having sufficient experience utilizing the WOSB program, the program:

Notably, the SBA updated its list of eligible industries for the program earlier this year. The March 2022 list of industries determines which WOSBs may receive set-aside (limited competition) and sole-source (noncompetitive) contracts from federal agencies.33 At the time of the writing of this report, the “SBA … considers WOSBs to be ‘substantially underrepresented’ in 646 six-digit NAICS [North American Industry Classification System] industry codes out of 1,023 total six-digit codes, and ‘underrepresented’ in 113 six-digit NAICS industry codes.”34

Recognizing that the federal government is the largest buyer of goods and services in the country35, and the potential for growth it offers for women-owned small business owners, Council Members have identified four key policy proposals to help achieve parity of the WOSB/EDWOSB federal contracting program and ensure more women business owners get their fair share of federal contract awards.

Council Members have identified four key policy proposals to help achieve parity of the WOSB/EDWOSB federal contracting program and ensure more women business owners get their fair share of federal contract awards.

Policy Recommendation

Fund, Expand, and Tailor Federal Financial Capability Resources for Women Small Business Owners

Although women entrepreneurs, particularly women of color, have expressed some concern and even frustration over receiving redundant training in lieu of access to capital opportunities36, Council Members agree that providing financial education tailored to suit women small business owners’ needs at every stage of the business cycle remains critical to ensuring business sustainability and success. Council Member subcommittee discussions on this topic centered around expanding existing resources or creating new customized programs which emphasize knowledge and skill-building for managing cashflow, engaging in financial document organization and emergency preparedness, building a “good” credit score, creating a capital stack, reinvesting in the business, and planning for business succession or a successful exit.

Council Member Roberta McCullough, for example, has noted the importance of helping women entrepreneurs better understand the impact that the U.S. credit scoring system can have on their business, while simultaneously urging for a careful assessment of proposals that look to reform or altogether overhaul the U.S. credit reporting system— a system which some argue is flawed, lacks transparency, and is likely the source of various and very troubling racial disparities.37 Additionally, Council Member Jaime Gloshay has expressed agreement on this point, and has also noted that because many women of color, such as Native women, may be self-funded and without access to relationship banking or investor networks, enhanced education together with well-sourced wraparound community-based supports could prove impactful.

While there are a whole host of federal financial education programs currently in existence, there is no dedicated source of funding to support tailored financial capability specifically for women small business owners at the ground level. Council Member Maria Rios has opined that dedicated funding to establish financial education grants to help bolster resource partners’ important work in this regard would be beneficial. Council Member Pamela Prince-Eason has also expressed agreement on this point and added that helping women business owners better understand and manage cash flow, create a strategic business plan, or properly prepare to hire that first employee are all fundamentally important,38 to a well-tailored program.

On background, SBA’s Ascent program currently includes a “fifth journey”— access to capital — to better prepare women business owners as they consider financing their dream. The journey covers five separate “excursions,” including: debt funding, equity resources, capital sources, banking relationships, funding pitches, and angel investing.39 Additionally, as highlighted in past NWBC annual reports, SBA remains an active participant of the twelve-member Financial Literacy and Education Commission (FLEC).40 SBA has also partnered in recent years with the Federal Deposit Insurance Corporation (FDIC) to develop and later update the Money Smart for Small Business41 program and curriculum available in English and Spanish. Council Members are encouraged by SBA’s ongoing efforts, which may be taken one step further by leveraging dedicated financial education grants for certain small business resources partners engaged in this work.

Policy Recommendation

Moreover, this legislation is positioning more small businesses to grow and create new jobs by “doubling the research and development (R&D) tax credit for small businesses” from $250,000 to $500,000.

Provide Additional Relief for WOSBs Impacted by Ongoing Supply Chain Disruptions and Workforce Availability Issues

Small business owners, including women business owners, continue to deal with ongoing supply chain disruptions and labor shortages, stemming in part from a post-COVID economic recovery, global inflation, and geopolitical conflicts abroad.42 While women business owners remain resilient and optimistic, the Council contends that additional relief is needed moving forward.

On background, the Employee Retention Credit (ERC) provided for in the Coronavirus Aid, Relief, and Economic Security (CARES) Act is a payroll tax refund available to certain employer-based firms that experienced a significant decline in gross receipts in 2020 or during the first three quarters of 2021 or experienced a “full or partial suspension of operations due to a government order if … the business’ suppliers [were] unable to make deliveries of critical goods or materials due to a governmental order that cause[d] the supplier to suspend its operations.”43 However, supply chain disruptions persist. Small business owners, particularly WOSBs, require and could benefit from an expansion of this type of tax relief for additional losses sustained beyond 2021.

Beyond tax relief measures, however, it is also worth mentioning that in 2021, the Biden-Harris Administration established a “Supply Chain Disruptions Task Force” to address short-term supply chain discontinuities.The White House also released an assessment of four products identified as critical at the time including: “semiconductor manufacturing and advanced packaging; large capacity batteries; … critical minerals and materials; and pharmaceuticals and active pharmaceutical ingredients (APIs)”44 to support investments in the President’s American Jobs Plan.

Additionally, the “Inflation Reduction Act [IRA], which includes expanded or extended tax credits and additional funding for the IRS, was signed into law on August 16, 2022.”45 According to the White House, “the Inflation Reduction Act will reduce costs for small businesses by maintaining lower health care costs, supporting energy-saving investments, and bolstering supply chain resiliency.”46 For instance, the legislation signed into law in August 2022 helps cut energy costs for small businesses. Small businesses that switch over to low-cost solar power may be eligible for a tax credit; small business building owners may also “receive a tax credit up to $5 per square foot to support energy efficiency improvements,” and those that “use large vehicles like trucks and vans will benefit from tax credits covering 30 percent of purchase costs for clean commercial vehicles.”47

Moreover, this legislation is positioning more small businesses to grow and create new jobs by “doubling the research and development (R&D) tax credit for small businesses” from $250,000 to $500,000. And, among other provisions, IRA “includes targeted tax incentives aimed at manufacturing U.S.-sourced materials like batteries, solar, and wind parts, and technologies like carbon capture systems and electrolyzers to make hydrogen.”48 Moreover, it is described as a critical step toward making the U.S. tax code fairer by ensuring that the larger corporations “pay taxes they already owe … and cracking down on … corporations with more than $1 billion in annual profits,” as well as “imposing a 1 percent surcharge on corporate stock buybacks.”49

While all these and similar efforts and accomplishments are laudable, this Council also urges the White House and Congress to identify new opportunities to expand tax relief for small business owners as well as consider easing eligibility requirements,50 particularly for care economy businesses and those in industries with a significant women and minority business owner presence, and that experience a significant interruption in their operations and loss of revenue due to ongoing supply chain disruptions and/or labor shortages. Given the possible challenges that may still lie ahead, expanding tax relief such as the ERC and simplifying qualifying criteria as well as records submission requirements would potentially provide much needed relief for these struggling businesses.

Policy Recommendation

Women in Stem

Women in Academic Innovation

Women’s lack of inclusion in today’s innovation ecosystem and STEM entrepreneurship remains concerning to Council Members. While the gender gap within STEM disciplines continues to slowly narrow, gender parity in innovation will not happen within our lifetimes by most estimates.51, 52 Nonetheless, women represent an important source of untapped potential for spurring American innovation and entrepreneurship. Women are becoming more involved in academic settings than ever. About half of U.S. doctorates are earned by women. Additionally, academic institutions are now the largest employer of women with doctorates in science, engineering, and health (SEH).53, 54 However, while the presence of women in academia grows and universities expend billions of dollars in research, secure thousands of patents, and incubate and accelerate hundreds of startups each year,55 only a small percentage of women end up participating as a sole female founder or co-founder.56

Notably, only 11 percent of approximately 6,000 academicbased companies surveyed by Osage University Partners, analyzed in 2017, had a female scientific founder or co-founder.

The current landscape reflects a lack of intentional inclusion of women in innovation and business opportunities and a lack of supports for professionals with caretaking responsibilities, further weakened by COVID-19. Specifically, with respect to women’s journeys in STEM careers, the gap in leadership and innovation curiously begins to widen as women progress in their profession. This is often referred to as a “leaky pipeline” for those in highly specialized fields, including business and management consulting.57 A 2022 Stanford Social Review article suggests that women divert from STEM not because of their individual life choices, but rather, “because opportunities begin to diminish [due to] systemic barriers and layers of biases.” 58 Worst of all, the lack of inclusion of women in innovation negatively impacts the effectiveness, or even the availability, of a much-needed product. The article goes on to say, “the impact of these barriers and biases extends beyond workplaces; they shape STEM products and innovations themselves. Multiple studies have shown that gender and racial bias in product design can have significant, even deadly, effects.”59

Given these considerations, Council Members serving on the “Women In STEM” policy subcommittee expressed interest in exploring best practices for leveraging academic innovation to strongly position women to engage in all stages of the innovation lifecycle, including in patenting, commercialization, and STEM business ownership. This year, Council Members heard from subject matter expert Jane Muir, who founded her own consulting firm following a 25-year career in technology commercialization at the University of Florida’s (UF) “Innovation Hub,” helping pair entrepreneurs with development opportunities and making strategic connections between participants and prospective investors. Ms. Muir’s presentation before the subcommittee titled, “Engaging More Women in Academic Innovation” featured findings from her own research. The presentation highlighted the following key takeaways, which served as a starting point for further Council Member discussion. It is critically important to consider:

Council Member Roberta McCullough was highly receptive to the presentation, particularly the point on considering utilizing weighted criteria to ensure the creation and implementation of a DEI plan as a requirement for research institutions on all federal grant applications. In her words, “that which gets measured gets done.” Additionally, there was consensus among Council Members that failing to ensure greater inclusion of minorities and women should have consequences, impacting institutions’ federal research funding bottom line. Council Member McCullough also emphasized the value of mentorship and suggested that certain local resources, such as WBCs, are well-positioned to support or partner with universities in their outreach efforts to innovators. Related to this topic, Council Member Selena Rodgers Dickerson shared key insights on how to better support recent graduates and new professionals so that they are armed with a strong understanding of basic principles and the fundamental technical skills needed to fully participate in innovation as well as collaborate on existing projects. She also underscored the importance of coupling practical technical application with business education.

In short, Council Members aligned on the importance of expanding efforts that encourage and invest in the development and active participation of more women in academia to not only embark on STEM careers, but also to consider entrepreneurial paths to bring needed products to market, create jobs, and build wealth. Targeted outreach to women in academic settings, relevant mentorship opportunities, and adoption and robust implementation of DEI plans will be key to achieving impactful results. Given that academia receives significant amounts of federal funding, the government is uniquely positioned to incentivize universities to catalyze progress by ensuring women’s engagement and inclusion in academic innovation.

In the interim, policymakers and certain federal government agencies continue to reassess their programs and resources on an ongoing basis, aiming to reach more minorities and women innovators across different fields and levels of education. Whether through the opening of a new WBC at a university, tailoring federal resources and initiatives, or advancing legislation that directly supports women in STEM, Council Members nevertheless agree that a multifaceted, interagency approach will likely bring about the most impactful results. Notably, at the time of the writing of this report, the U.S. Patent and Trademark Office (USPTO) Director Kathy Vidal announced the launch of its Women’s Entrepreneurship (WE) initiative:

“a community-focused, collaborative, and creative initiative to inspire women and tap their potential to meaningfully increase equity, job creation, and economic prosperity” during National Entrepreneurship Month in November 2022.60 The goal is to leverage the expertise of stakeholders, including women entrepreneurs, funders, and strategists to help champion women innovators and business owners. As part of this initiative, USPTO has also already announced its 2023 Women’s Entrepreneurship Symposium, a three-part event series covering innovation and business topics and featuring public and private sector experts.61

Also, earlier in the year, SBA Administrator Isabella Casillas Guzman announced over $5.4 million in funding to 44 awardees through the Federal and State Technology (FAST) Partnership Program. SBA’s FAST program “provides small businesses and startups, particularly those in underserved communities, with specialized training, mentoring, and technical assistance for research and development. Grant selectees qualify for award amounts of up to $125,000 each.” The Council is encouraged by Administrator Guzman’s steadfast commitment to prioritizing minorities and women in SBA’s programs like FAST.

Given that academia receives significant amounts of federal funding, the government is uniquely positioned to incentivize universities to catalyze progress by ensuring women’s engagement and inclusion in academic innovation.

Policy Recommendation

High Yield and High Growth Fields with Low Levels of Women-Owned Business Representation

Noting the Administration’s focus on rebuilding our nation’s infrastructure, NWBC considered factors to help increase women’s inclusion, employment, and contract procurement opportunities in high growth industries such as architecture, engineering, and construction (AEC) and other STEM high-yield fields. Council Member Selena Rodgers Dickerson, who owns and leads an engineering design and project management firm, shared during policy subcommittee discussions that language to promote women’s inclusion in STEM careers and contracting opportunities often excludes the AEC field. The latest statistics indicate that women in the U.S. continue to be underrepresented in the AEC industry. For instance, about “27 percent of professionals who specialize in the Architecture and Engineering are women. Women in Construction represent only about 11 percent”62 according to the U.S. Bureau of Labor Statistics.63

Once again, Council Members participating in the Women in STEM policy subcommittee believe that targeted outreach to women as well as industry-relevant business management mentoring opportunities are lacking for those involved in high-yield and high-growth specialized fields. And, while women in these fields with lower representation experience less significant gender pay disparities,64, 65, 66 the industry’s male-dominated culture and networking opportunities often keep highly qualified women business owners out of state and federal procurement opportunities, particularly those operating in the AEC industry. Notably, with the implementation of the BIL as well as the IRA, the AEC industry and other STEM-adjacent fields are now becoming high-growth industries. Concurrently, government agencies like SBA, Commerce, and DOT are coordinating efforts to encourage greater participation in opportunities presented by the BIL. As U.S. Transportation Secretary Pete Buttigieg said, “these new initiatives with our partners at SBA and MBDA will help more small business owners secure federal contracts to modernize our country’s infrastructure for decades to come.”67 Keeping in mind these growing opportunities as well as the Biden-Harris Administration’s focus on ensuring greater inclusion of minorities and women in federal contracting opportunities, NWBC will remain laser-focused on awards to women-owned businesses in these fields.

Leveraging the Biden-Harris administration’s prioritization of women and minorities in the implementation of the BIL, support for legislation focused on increasing the number of diverse women innovators in accelerators, and increasing federal procurement opportunities will enable trailblazers to cut a path of success for future entrepreneurs. Additionally, new research into women’s participation in high-yield and high-growth fields will be important. It will help to further inform evidence-based outreach, mentoring, and training practices. Updated research will shed light on factors that explain significant discrepancies between women’s low participation in these more resilient industries, in comparison to their participation in other industries that tend to be more economically and socially vulnerable.

For instance, according to a 2022 survey, most women small business owners worked in:

22.32 %

16.07 %

22.32 %

16.07 %

12.50 %

11.61%

12.50 %

11.61%

5.36%

Updated research will shed light on factors that explain significant discrepancies between women’s low participation in these more resilient industries, in comparison to their participation in other industries that tend to be more economically and socially vulnerable.

Moreover, as was referenced in a 2022 Politico “Women Rule Panel,” which included NWBC’s Executive Director Tené Dolphin, women-owned businesses are often more concentrated in industries that have been heavily impacted by the pandemic, both in terms of unemployment and physical/psychological toll. They are also overrepresented in industries that can experience downturns during periods of economic stagnation.69, 70

By contrast, the healthcare and technology industries are expected to grow quickly due to longer life expectancies and technological advancements. However, manufacturing and retail are expected to decline due to automation and e-commerce, respectively.71 When it comes to yield, the industries with the greatest predicted revenues mirror these results.72 Thus, looking beyond the pandemic, it will be important to address how to best attract, actively recruit, prepare, and invest in the inclusion of more women in resilient, higher growth, and higher yield industries.

Policy Recommendation

The STEM Pipeline

Women In STEM subcommittee members also discussed effective strategies to rebuild the women’s STEM entrepreneurship pipeline. Fair access to primary, postsecondary, and undergraduate education, as well as post-graduate training, accessible industry-specific mentorship opportunities, and more dynamic resource partner collaborations in STEM remained at the forefront of this year’s subcommittee discussions. For instance, Council Member Selena Rodgers Dickerson said that STEM education should be clearly defined and ensure that it is “all-STEM inclusive,” underscoring that women should have the opportunity to explore the full landscape of STEM opportunities beyond tech. They should be aware of opportunities in the AEC and environmental sciences and sustainability fields.73 Notably, recent data indicates slow progress for women achieving gender equality in environmental decision-making globally.74 Council Member Roberta McCullough echoed these sentiments, emphasizing the value of mentorship and practical skill development as a former educator.

As previously noted, historically, women’s progress in STEM careers often stagnates for a myriad of issues. However, the “leaky pipeline”75 in STEM is most proximately tied to systemic issues such as institutionalized gender-based bias, starting as early as the K-12 level before moving to the university setting and beyond—in labs, technology transfer offices, and in the workforceThese trends seem to worsen over time. As one recent study found, “when asked to draw a scientist, 70 percent of 6-year-old girls draw a woman, while only 25 percent of 16-year-old girls do.” 76, 77 This bias creates a compounding effect by the time women reach college. Moreover, consider the following:

When women get to the professional arena, the ability to get a foot in the door or re-enter after leaving the STEM workforce also proves difficult, as attested to by Council Member Rodgers Dickerson during one subcommittee meeting. She shared her own experience and that of her peers as they struggled to seek out and find meaningful professional mentorship opportunities. Given these experiences, she suggested during discussions that entrepreneurial ecosystem builders, together with small businesses, could play a more active role in supporting new entrepreneurs with true potential for growth. Council Member McCullough concurred, and both also discussed the need to bolster online resources with targeted, robust content tailored for distinct industries. Increased resources to ensure more targeted, industry-specific interactive content and mentorship opportunities could also help support the important work of small business resource partners, including WBCs and new Community Navigator grantees. More robust interactive educational, training, and mentorship opportunities could help resource partners like WBCs connect a more diverse set of clients with subject matter experts and robust technical assistance programs.

In short, creating a more equitable, inclusive, and leak-proof pipeline for women in STEM may require interventions at multiple levels and from multiple sources. Bolstering STEM education opportunities at the elementary, middle, and high school level could get more women into STEM by the time they reach college. From there, academia, local resource partners, and small businesses can collaborate to help recruit and keep more women in STEM careers and business opportunities. However, plugging the holes in the leaky pipeline that prevents women from achieving their STEM goals will require higher levels of investment at each entry point. By doing so, we might get closer not only to achieving parity but also a more robust recovery and faster economic growth.

Bolstering STEM education opportunities at the elementary, middle, and high school level could get more women into STEM by the time they reach college.

Policy Recommendation

RURAL WOMEN’S ENTREPRENEURSHIP

Persistent Barriers to Rural Women’s Entrepreneurship: Lack of Affordable Childcare and Equitable Paid Family and Medical Leave (PFML)