Download Annual Report PDF

Download Annual Report PDF

I am excited and honored to have joined the National Women’s Business Council—NWBC—as of August 2021. On behalf of this Council, I am pleased to present our 2021 Annual Report and policy recommendations.

This is certainly an exciting and critical time of transition, recalibration, as well as an opportunity to refresh our public engagement and advocacy efforts on behalf of women entrepreneurs across the country. I am also proud of our shared history and grateful for the passionate advocates and allies who helped cement the foundation and important work of this congressionally mandated Council.

Many thanks to all the women leaders who have come before us and fearlessly championed greater equity and inclusion for women business owners-- to all those who have left NWBC better and stronger. We stand on your shoulders.

As we now await the onboarding of our next NWBC Chair and learn of her vision for the year ahead, the Council remains dedicated to its core mission of serving as a source of advice and counsel to the President, Congress, and the U.S. Small Business Administration on issues of greatest impact to the approximately 12 million women business owners in the country.

Throughout this year, the Council and NWBC staff took decisive yet measured steps to remain engaged on key policy issues and trends impacting women’s business enterprise. The Council learned of persistent barriers to entrepreneurship amplified at the onset of the COVID-19 global pandemic, carefully examined key policy trends, and deliberated on the recommendations featured in this report aimed at helping women build back better and stronger.

Women business owners continued to demonstrate that they are resilient—they have triumphed over adversity before and are doing that once again. Nonetheless, NWBC continues to ask the hard questions, to spearhead the research, and share impactful policy and programmatic recommendations that can help make the entrepreneurial journey more inclusive and equitable. As our country positions itself for the “comeback” women business owners will continue to be at the forefront of building back a better tomorrow for all.

While the COVID-19 pandemic exacerbated existing challenges, which added more stress and pressure on women, it also shed light on archaic work models as well as systemic gender-based stereotypes and racial biases. Nevertheless, women have demonstrated amazing resilience by pivoting and reimaging their careers, businesses, personal lives, and their roles as advocates. Yet, there is still much to do.

As recently reported in Black Enterprise, 32% of workers have left their jobs to start their own business. Whether this pivot to entrepreneurship has been in response to an inflexible work environment, or whether the crisis simply made women reevaluate their value and worth, the pandemic’s silver lining has been to raise greater awareness about unacceptable inequities.

Of total women-owned businesses approximately:

10,550,000 (90.3%) are nonemployer firms generating $286.1 billion in revenue in 2017.b They represent 41.7% of all nonemployer firms.

b. Nonemployer firms do not include C corporations.

- Majority Men-Owned

- Majority Women-Owned

- Equally Men- and Women-Owned

- Other

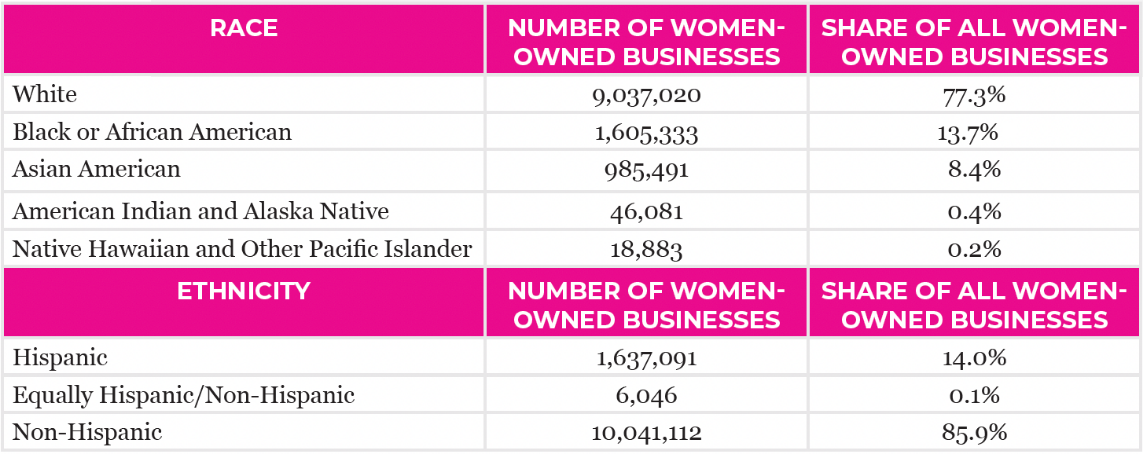

In recognition that race and ethnicity are different and overlap, the Census Bureau and National Women’s Business Council (NWBC) treat them as distinct groups.

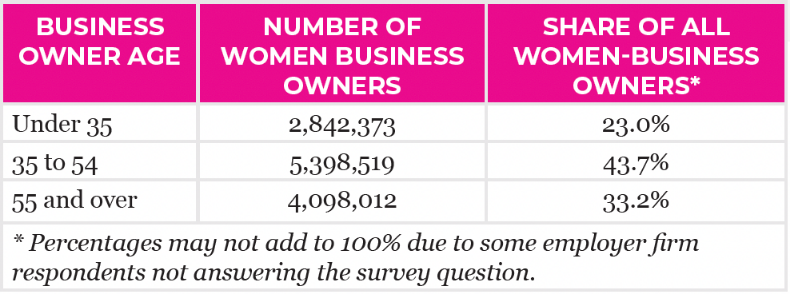

Most women business owners (76.9%) are over the age of 35.

There are approximately 155,382 veteran women-owned businesses in the U.S. 3 They comprise 1.3% of all women business owners and 8.8% of all veteran business owners, about the same percentage that women represent of overall veterans.4

Approximately 1,418,678 women business owners are not U.S. citizens, representing 11.5% of all women business owners and 38.6% of all immigrant business owners.

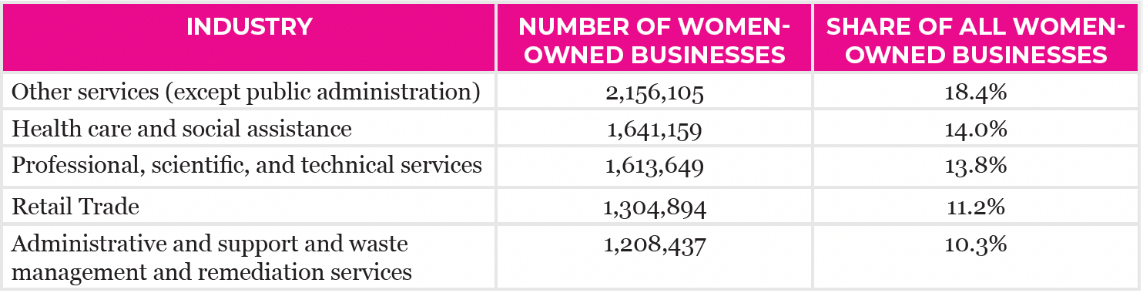

More than two-thirds of women-owned businesses (67.7%) are concentrated in five industries: other services; healthcare and social assistance; professional, scientific, and technical services; retail trade; and administrative and support and waste management and remediation services.

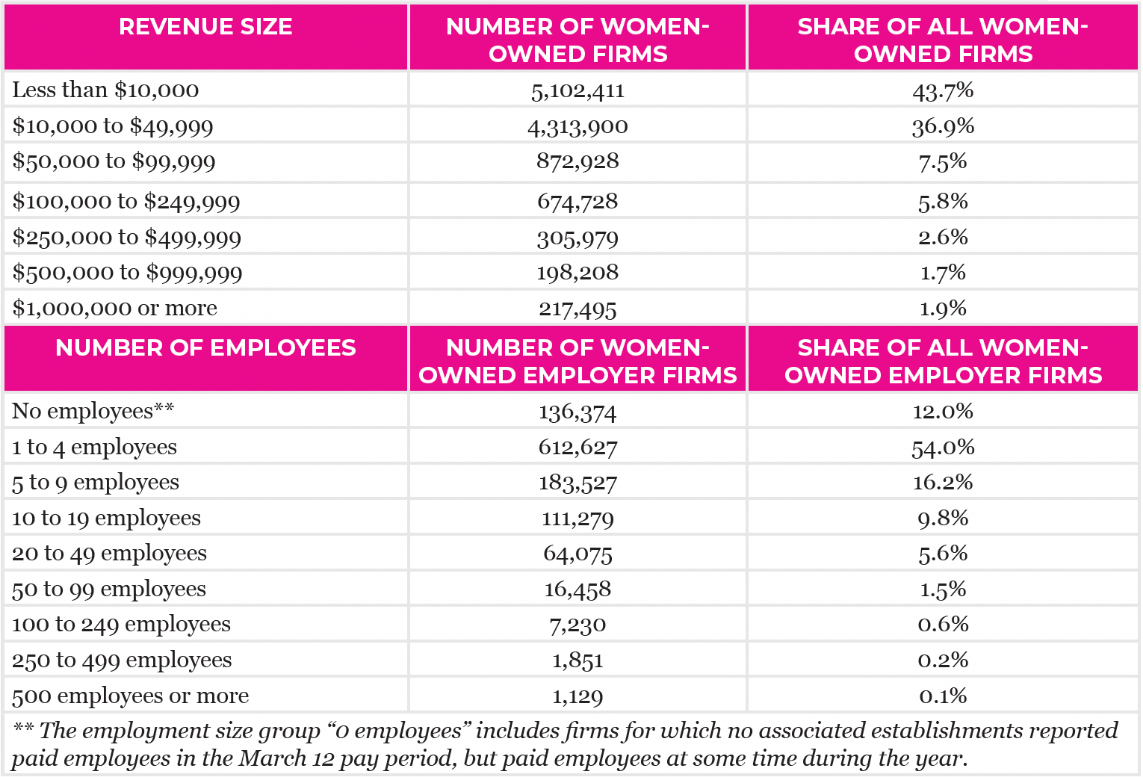

Most women-owned businesses (81.1%) generate less than $100,000 annually in revenue. Most women-owned employer firms (82.2%) employ less than ten workers.

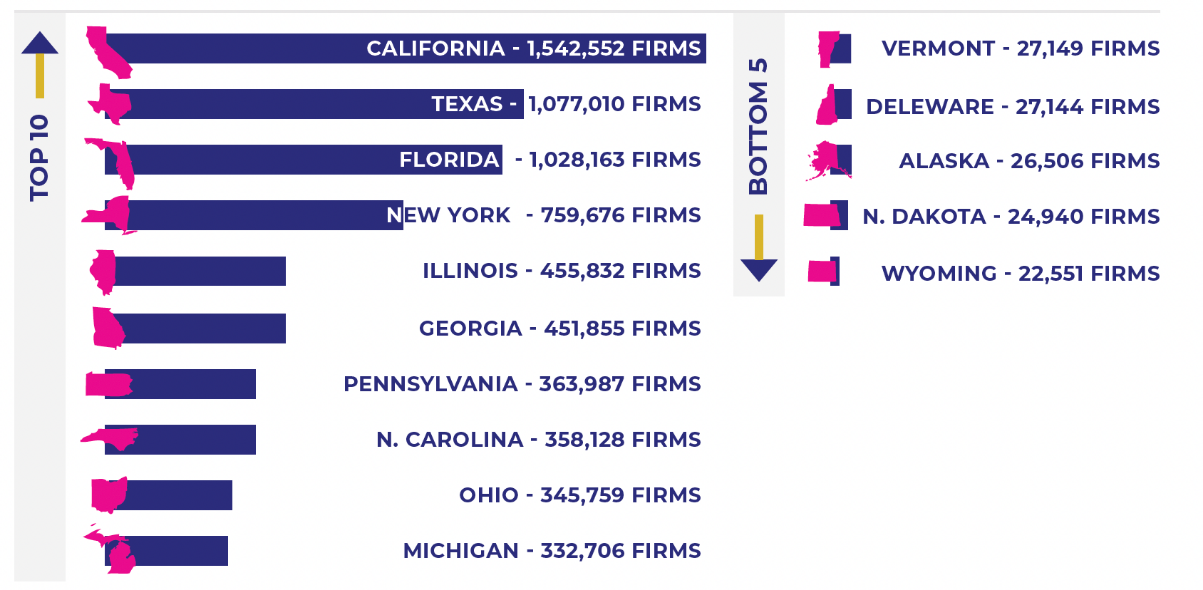

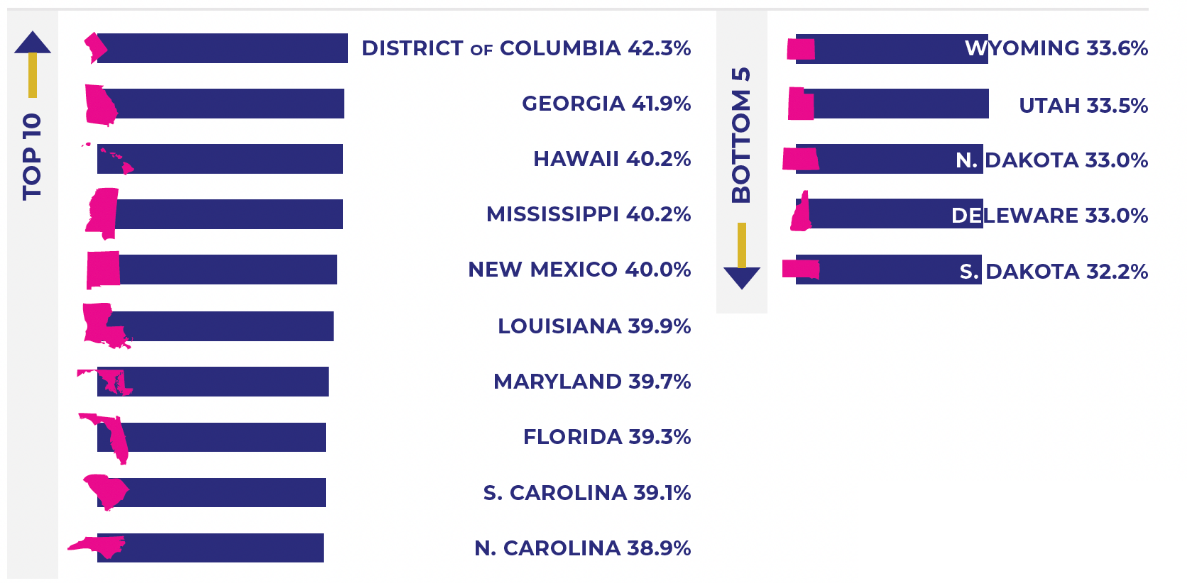

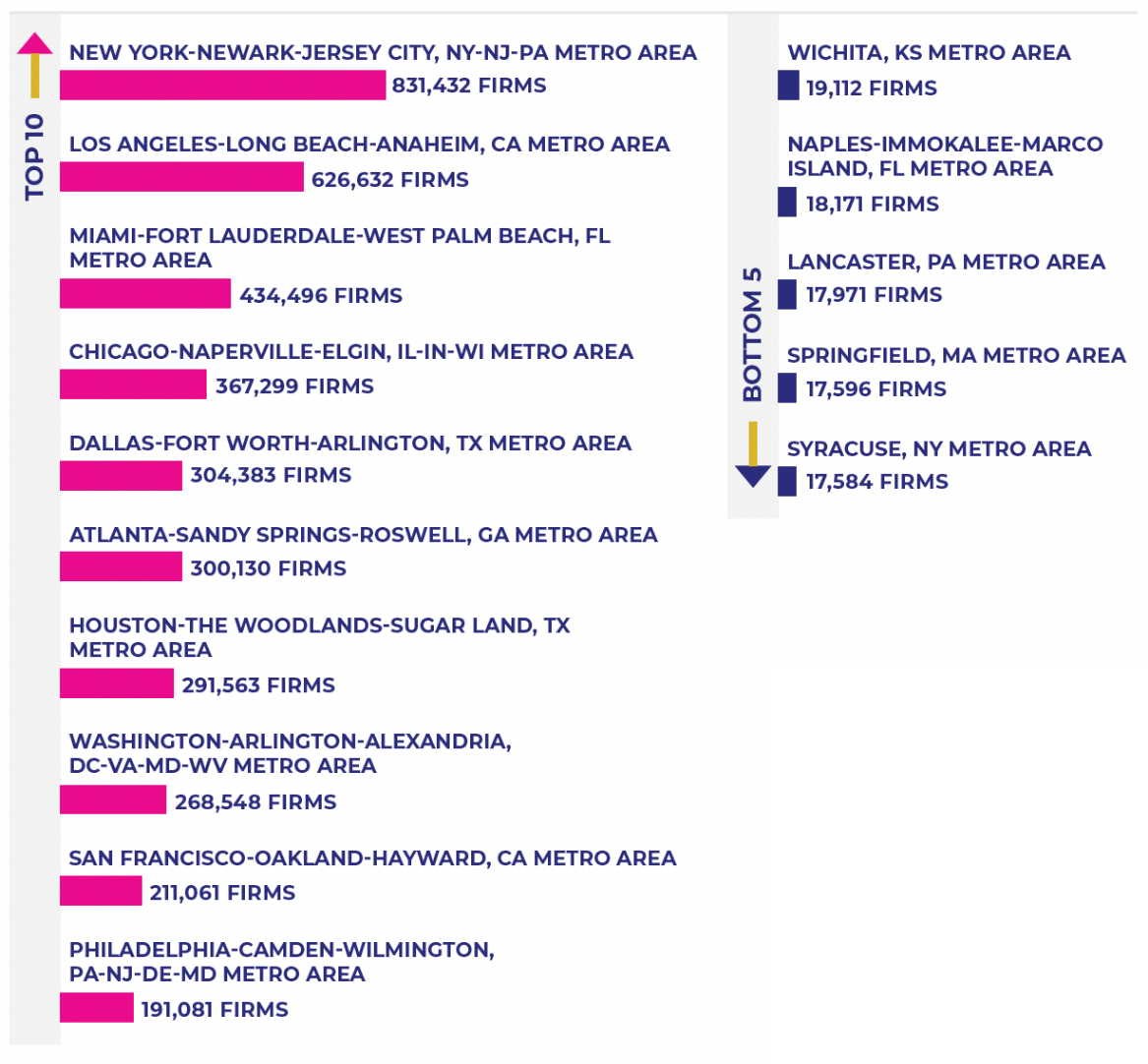

States: There are three states, Florida, Georgia, and North Carolina, with a relatively high number and share of women-owned businesses. All are in the south. There are three states, Delaware, North Dakota, and Wyoming, with a relatively low number and share of women-owned businesses.

including District of Columbia

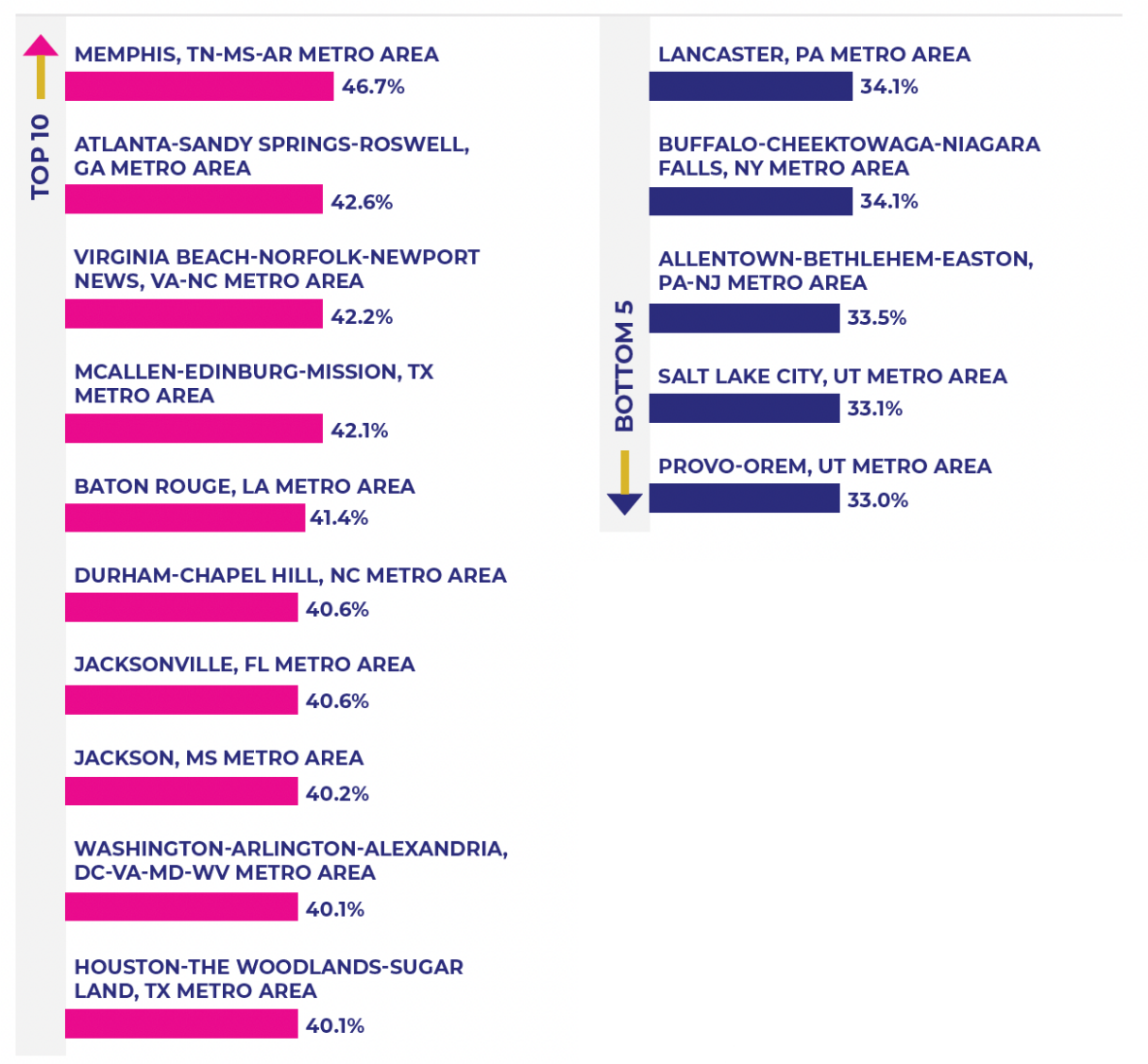

Metropolitan Statistical Areas (MSAs): There are three MSAs: the Atlanta-Sandy Springs-Roswell, GA Metro Area, the Houston-The Woodlands-Sugar Land, TX Metro Area, and the Washington-Arlington-Alexandria, DC-VA-MD-WV Metro Area, which have a relatively high number and share of women-owned businesses. The Lancaster, PA Metro Area, is the only MSA with a relatively low number and percentage of women-owned businesses.

REPRESENT OF ALL BUSINESSES

There are 9,023,000 women-owned businesses in urban areas accounting for 77.2% of all women-owned businesses and 38.4% of all urban businesses. There are 1,565,000 women-owned businesses in rural areas accounting for 13.4% of all businesses and 34.9% of all rural businesses.

Spotlighting Successful Venture Funds Investing in Diverse Women-Founded Enterprises

▪ NWBC recommends that the White House Gender Policy Council highlight successful high-performing venture funds making significant investments in minority women-founded enterprises, and further urges this Council to identify and share qualitative learnings and best practices.

Building Back a Better Pipeline of Women Entrepreneurs

▪ The Council supports S. 1109, the Minority Entrepreneurship Grant Program Act of 2021, to provide targeted grants for minority student entrepreneurs, and further encourages casting a wider net to ensure inclusion of minority women entrepreneurs by including a provision requiring a recruitment and retention plan and impact reporting with disaggregated demographic data.

▪ The Council supports S. 389, the Next Generation Entrepreneurship Corps Act, to create a competitive fellowship program for diverse entrepreneurs in distressed communities, and further recommends expanding this opportunity to midsized businesses ready to scale up, with a “Fast Track” to 8(a) and WOSB/EDWOSB certification.

Reassessing & Strengthening SBA’s Microloan Program to Better Serve Women Entrepreneurs in Emerging Markets

▪ The Council supports H.R. 1502, the Microloan Improvement Act of 2021, to help strengthen SBA’s Microloan Program and reach more micro and small minority women-owned businesses, and further recommends showcasing best practices and facilitating greater access by closely aligning eligibility requirements to SBA’s Paycheck Protection Program (PPP) requirements.

Narrowing the Wealth Gap for Women Entrepreneurs by Ensuring Parity for the WOSB/EDWOSB Federal Contracting Program

▪ SBA should improve the turnaround time for obtaining a WOSB/EDWOSB certification, and both Congress and SBA should work to ensure parity of the program by leveraging the same or greater contracting expectations, authority and penalties as other certification and contracting programs.

▪ SBA should review and increase resources to ensure effective education of both prospective WOSB founders as well as contracting officer representatives (CORs) across federal agencies.

▪ The SBA should give serious consideration to raising the scorecard goal of 5% for federal contract awards to WOSBs and EDWOSBs and provide “set-asides” for this program across industries.

Promoting Succession Planning Among Rural Women Entrepreneurs▪ The Council recommends enacting H.R. 971, the Small Business Succession Planning Act to provide business owners the support they need to create an online business succession plan, and further recommends placing special emphasis on targeting outreach to minority women entrepreneurs in underserved and rural communities across industries and include tailored outreach to women farm operators.

Providing Relief for Women Inheriting Rural Businesses and Farms

▪ Congress should mandate an independent economic impact study on the effects of expanding the estate tax exemption for an additional 10 years to 2035 and the effects of making it permanent at the current rate for rural small businesses as well as family and women-owned farms.

Evaluating Gaps in Data for Rural Women Business Owners and Farm Operators

▪ SBA and NWBC should collaborate on efforts to better assess available quantitative and qualitative data as well as identify gaps in research on rural minority women business owners in agriculture and across industries.

Addressing Family and Childcare Concerns as Barriers to Women’s Entrepreneurship

▪ NWBC should hold a roundtable in FY 2022 to review the Paid Family Medical Leave Act and further address lack of paid family leave options for underserved rural women entrepreneurs, sole proprietors, and business partners with infants or those planning to start a family by birth or adoption.

▪ The Council supports expansion of the Child Tax Credit to 2025 and encourages Congress to mandate an economic impact study on making it permanent, specifically noting the ramifications and prospective benefits to solopreneurs and women business owners with employees at the scaleup stage.

Advancing Diversity, Equity, & Inclusion to Support Rural Minority Women Business Owners ▪ The Council applauds the recent openings of new WBCs and encourages a continued focus on more openings in rural and underserved communities.

▪ SBA should showcase high-performing WBCs tailoring culturally competent entrepreneurial development programming to Native, Black, and Latina business owners.

Advancing Gender Equity in STEM Business & Innovation and Promoting Commercialization of New Technologies

▪ NWBC applauds the White House Gender Policy Council’s (WHGPC) commitment to “advancing gender equity and equality,” including by promoting women’s participation in STEM entrepreneurship across industries. The Council further encourages SBA as a member of the WHGPC, specifically through the Office of Investment and Innovation (OII), to address underrepresentation of women in innovation, patenting, trademark, and commercialization of new technologies by identifying gaps in research.

▪ The Council supports passage of H.R. 652, the Research Advancing to Market Production (RAMP) for Innovators Act, to improve the SBIR/STTR application peer review process by including commercialization potential and support. Further, the Council recommends emphasizing prioritization and inclusion of minority women entrepreneurs as well as requiring an outreach plan and impact report that includes disaggregated data by race and gender.

▪ The Council supports passage of S. 160, the Small Business Innovation Voucher Act, that would allow small businesses to work with any institution of higher education to compete for grants to facilitate public-private cooperation on R&D and commercialization of new technologies. The Council further recommends that this legislation emphasize and prioritize minority women-owned small businesses, that a certain amount of grant funding be set aside to support women-owned businesses, and that the report to Congress include disaggregated data on the inclusion of women and other underrepresented populations.

Increasing STEM Business Mentorship and Education Opportunities

▪ The Council recommends that SBA’s Ascent platform highlight and include relevant, existing federal resources uniquely tailored for Women STEM entrepreneurs including links to existing SBIR/STTR online tutorials, USPTO video trainings, and other relevant federal resources customized for women innovators.

▪ The Council recommends that SBA work in close collaboration with SCORE to ensure greater diversity of STEM mentors, and specifically recruit more women STEM business owner volunteers. SBA and SCORE should work to significantly increase the percentage of women mentors, including women of color, by establishing the baseline and committing to capturing metrics on an annual basis.

▪ The Council supports the passage of H.R. 2027, the MSI STEM Achievement Act, to increase STEM education at minority serving institutions of higher education. The Council further recommends prioritization of MSIs and HBCUs that partner with WBCs or other community-based programs focused on women’s business enterprise.

Supporting STEM Accelerator Programs Partnering with MSIs and HBCUs

▪ The Council supports passage of S. 64, the Ushering Progress by Leveraging Innovation and Future Technology (UPLIFT) Act, which would create an Innovation Centers Program within SBA with the aim to provide HBCUs, MSIs, and community colleges with the resources to establish and expand incubators and accelerators for the underserved.

Improving Demographic Data Collection on Minority Women Inventor Patentees

▪ The Council encourages passage of H.R. 204, the STEM Opportunities Act, which in part provides for guidance, data collection, and grants for groups historically underrepresented in STEM education at institutions of higher education and at federal science agencies, and also encourages recruitment and retention of minority students and career staff.

As Council Members have noted and is reflected in the most recently available, pre-pandemic data, the country’s total population consists of more than 166 million females,5 with approximately 12 million women-owned businesses in the U.S., and about 1.1 million women-owned employer firms that collectively employ more than 10 million workers.6 Yet, despite women’s awesome presence in the marketplace, as both consumers and business owners, global venture capital (VC) and equity financing for women-led startups is anemic at best—this past year turning slightly downward to about 2.8%.7

Additionally, many women business enterprise advocates opine that access to federal contracting opportunities for women business owners and actual contract awards remains lackluster, also severely limiting their growth opportunities.8 The WOSB federal contracting program “designed to help federal agencies achieve [a] statutory goal of awarding at least 5% of their federal contracting dollars to WOSBs” by allowing for set-asides “in industries in which WOSBs are underrepresented … has met the 5% procurement goal only twice—in FY2015 and FY2019—since the goal was authorized in 1994.”9 As members of this Council’s Access to Capital & Opportunity Subcommittee have underscored repeatedly, this inequity continues to hamper women’s ability to bring to market innovative products and services, while also limiting their ability to build generational wealth.

Given the current landscape, the Council forged ahead this year by doubling down on common pain points women business owners continue to experience as customers attempting to access relief funding or startup and scaleup financing, and as prospective contractors vying for federal contracting opportunities. The policy recommendations that follow reflect the Council’s deliberations and access to capital and opportunity focus areas for fiscal year 2021.

NWBC recommends that the White House Gender Policy Council highlight successful high-performing

venture funds making significant investments in minority women-founded enterprises, and further

urges this Council to identify and share qualitative learnings and best practices.

NWBC recommends that the White House Gender Policy Council highlight successful high-performing

venture funds making significant investments in minority women-founded enterprises, and further

urges this Council to identify and share qualitative learnings and best practices.The WHGPC is ideally positioned to help identify individual investors, fund managers, and relevant federal government experts already collaborating on efforts to increase investments in minority women-founded companies, particularly innovative startups with high-growth potential focused on solving, for example, global health and environmental problems. More specifically, WHGPC leadership could leverage this important initiative and national platform to highlight successful high-performing venture funds making significant investments in minority women-led enterprises by facilitating public discussions to help identify existing successful partnerships, qualitative learnings, key quantitative data, best practices and relevant program or business models that may further encourage and possibly incent increased investments in women-led startups.

The Council supports S. 1109, the Minority Entrepreneurship Grant Program Act of 2021, to provide

targeted grants for minority student entrepreneurs, and further encourages casting a wider net to

ensure inclusion of minority women entrepreneurs by including a provision requiring a recruitment

and retention plan and impact reporting with disaggregated demographic data.

The Council supports S. 1109, the Minority Entrepreneurship Grant Program Act of 2021, to provide

targeted grants for minority student entrepreneurs, and further encourages casting a wider net to

ensure inclusion of minority women entrepreneurs by including a provision requiring a recruitment

and retention plan and impact reporting with disaggregated demographic data.

The Council further comments and recommends that a provision be added to ensure funding resources are not only limited to enrolled MSI and HBCU student entrepreneurs, but also be made available to women business owners from the local community. Council Member Nicole Cober suggested during deliberations that this could be accomplished by also leveraging Procurement Technical Assistance Centers’ (PTACs) and other small business resource partners’ programming such as those delivered by Women’s Business Centers (WBCs) and Small Business Development Centers (SBDCs). Additionally, the Council urges inclusion of an outreach and impact reporting plan with disaggregated demographic data to ensure robust recruitment of minority women entrepreneurs, which should be prioritized from the very start. NWBC Executive Director and Designated Federal Officer Tené Dolphin provided a thought for Council Member consideration during final deliberations that to authentically advance equity, program participants should certainly ensure Additionally, the Council urges inclusion of an outreach and impact reporting plan with disaggregated demographic the inclusion of women, but also truly reflect the demographics of the local community with respect to race, industry, and business size. a

The Council supports S. 389, the Next Generation Entrepreneurship Corps Act, to create a

competitive fellowship program for diverse entrepreneurs in distressed communities, and further

recommends expanding this opportunity to midsized businesses ready to scale up, with a “Fast Track”

to 8(a) and WOSB/EDWOSB certification.

The Council supports S. 389, the Next Generation Entrepreneurship Corps Act, to create a

competitive fellowship program for diverse entrepreneurs in distressed communities, and further

recommends expanding this opportunity to midsized businesses ready to scale up, with a “Fast Track”

to 8(a) and WOSB/EDWOSB certification.

NWBC further asserts that given the historical lack of access to capital for women founders, it is imperative that women minority startups and midsized scaleups be afforded an equal opportunity to participate in the fellowship program. They should also be extended the opportunity to gain access to both 8(a) and to WOSB/EDWOSB “Fast Track” certification. Additionally, regarding the inclusion of the SBA Mentor Protégé program, this competitive fellowship should place emphasis on women by developing and implementing innovative strategies that facilitate mentor-mentee connections.16

The Council supports H.R. 1502, the Microloan Improvement Act of 2021, to help strengthen SBA’s

Microloan Program and reach more micro and small minority women-owned businesses, and further

recommends showcasing best practices and facilitating greater access by closely aligning eligibility

requirements to SBA’s Paycheck Protection Program (PPP) requirements.

The Council supports H.R. 1502, the Microloan Improvement Act of 2021, to help strengthen SBA’s

Microloan Program and reach more micro and small minority women-owned businesses, and further

recommends showcasing best practices and facilitating greater access by closely aligning eligibility

requirements to SBA’s Paycheck Protection Program (PPP) requirements.These measures could potentially benefit women entrepreneurs in disadvantaged communities, particularly if SBA invests greater resources to target and expand its outreach efforts to women entrepreneurs and WOSBs. For example, the agency could amplify collaboration with key resource partners, including WBCs and new Community Navigators Pilot Program grantees, to educate women entrepreneurs about new microloan terms and offerings. Additionally, to the extent that the COVID-19 emergency created a real sense of urgency, the Council opines that achieving equity on the access to capital front should be treated with equal seriousness. As such, NWBC further recommends that SBA explore aligning Microloan Program eligibility requirements with those of the Paycheck Protection Program (PPP). Also, less onerous eligibility standards could be coupled with the development of any SBA direct microloan and/or future direct loan offering.

SBA should improve the turnaround time for obtaining a WOSB/EDWOSB certification, and both

Congress and SBA should work to ensure parity of the program by leveraging the same or greater

contracting expectations, authority and penalties as other certification and contracting

programs.

SBA should improve the turnaround time for obtaining a WOSB/EDWOSB certification, and both

Congress and SBA should work to ensure parity of the program by leveraging the same or greater

contracting expectations, authority and penalties as other certification and contracting

programs.As the first part of a three-pronged approach to strengthen and ensure parity for the WOSB/EDWOSB federal contracting program, the Council recommends Congress should provide SBA with the necessary resources to improve WOSB/EDWOSB certification turnaround times, as well as develop and implement innovative approaches to increase the number of actual sole source federal contracts awarded to WOSBs. Moreover, during deliberations, Past Chair Liz Sara and various other Council Members suggested that another way to “start moving the needle” is to “give the program more teeth” by creating program parity with other SBA Small Disadvantaged Business programs19 such as the 8(a) Business Development Program.20 This could be accomplished by leveraging the same or greater contracting expectations, authority, and penalties as for other contracting programs. Notably, this recommendation was shared during NWBC’s May 5th, 2020 #LetsTalkBusiness, Access to Capital & Opportunity Roundtable21 and in subsequent deliberations.

SBA should review and increase resources to ensure effective education of both prospective WOSB

founders as well as contracting officer representatives (CORs) across federal agencies.

SBA should review and increase resources to ensure effective education of both prospective WOSB

founders as well as contracting officer representatives (CORs) across federal agencies.Council Members have also expressed concerns that overall, many contracting officers across federal agencies may not be fully aware of their role in ensuring WOSBs get their fair share of contracting opportunities. Therefore, the second prong of this approach includes further educating or retraining both current and prospective contracting officers so that they have a clear understanding of the program and feel equipped and empowered to leverage the sole sourcing option, thereby increasing the number of actual awards to qualified WOSBs and EDWOSBs.

The SBA should give serious consideration to raising the scorecard goal of 5% for federal contract

awards to WOSBs and EDWOSBs and provide “set-asides” for this program across industries.

The SBA should give serious consideration to raising the scorecard goal of 5% for federal contract

awards to WOSBs and EDWOSBs and provide “set-asides” for this program across industries.

Nonetheless, Council Members continue to argue that women business owners are severely underrepresented in federal contracting across all industries, taking into consideration that women comprise more than 50% percent24 of the U.S. population and outpace men in creating businesses. Further, as previously noted, as of 2019, women-owned businesses represented an estimated 42% of all U.S. businesses (nearly 13 million businesses), employed 9.4 million workers, and generated $1.9 trillion in revenue in the same year,25 yet only garner a small fraction of federal contracts. Additionally, recent data suggests “a widening gender gap for contracts26 at the federal level show[ing] how women-owned small businesses have been shut out from the largest contracts.” During NWBC’s May 5th Access to Capital & Opportunity roundtable, several participants flagged contract “bundling” as a potential barrier to greater access. Some also emphasized that “the federal government needs to start asking whether bigger businesses are really meeting all their socioeconomic goals.”

However, significant barriers to rural entrepreneurship and innovation, which include manufacturing moving overseas, larger companies’ farming dominance “with only 5% of rural residents working in agriculture, generational migration to bigger cities, school consolidation, and the absence of basic resources”31 and critical services such as accessible healthcare32 and home- or child care33 continue to hold rural women entrepreneurs back from starting or growing a business. This unique set of issues, together with persistent challenges faced by women across the country, including lack of access to capital and limited culturally competent entrepreneurial development opportunities, may leave underserved Native, minority immigrant (including non-English speakers), and women of color to feel as though there isn’t a clear path forward to secure their business, the welfare of their employees, and their own personal financial security.

Given these challenges, Council Members’ fiscal year 2021 deliberations focused on some of the most persistent issues weighing down rural minority women entrepreneurs—those turning to necessity entrepreneurship, those with businesses at the scaleup stage, and those who enter the market through inheritance or participation in a family-run business or farm. As the policy recommendations in this section reflect, members of this Council’s Rural Women’s Entrepreneurship Subcommittee identified succession planning, inheritance and estate taxes, lack of available home- and child care, limited access to culturally competent entrepreneurial resources, and significant gaps in available data on U.S. rural women entrepreneurs as an urgent set of issues requiring further careful examination and innovative, evidence-based solutions.

The Council recommends enacting H.R. 971, the Small Business Succession Planning Act to provide

business owners the support they need to create an online business succession plan, and further

recommends placing special emphasis on targeting outreach to minority women entrepreneurs in

underserved and rural communities across industries and including tailored outreach to women farm

operators.

The Council recommends enacting H.R. 971, the Small Business Succession Planning Act to provide

business owners the support they need to create an online business succession plan, and further

recommends placing special emphasis on targeting outreach to minority women entrepreneurs in

underserved and rural communities across industries and including tailored outreach to women farm

operators.With respect to agricultural businesses, “while the average farmer is aging out of the industry … with no succession plan” in place, a new generation of women farm operators are currently entering the market through their own volition. A recent U.S. Department of Agriculture (USDA) article highlights that “an increasing number of young [women are coming] into the field after college with multiple degrees … [m]any from areas not traditionally considered related to Ag[riculture]—such as finance, marketing, and science—but bring a whole new way of doing business.”38 Nonetheless, keeping in mind everyday business management demands and the challenges unique to rural entrepreneurship such as a shrinking workforce, lack of access to broadband, and lack of affordable or available home, elder or child care options, many rural women business entrepreneurs are “forced to focus primarily on the day-to-day operations of running a business.” b

Notably, a 2017 survey conducted by the Wilmington Trust suggests that lack of time and resources for succession planning is an issue impacting many small business owners across the country.39 Survey findings include the following:

The Council further encourages that additional resources and outreach efforts be directed at reaching more women business owners in underserved communities, placing special emphasis on rural women business owners, including family farm operators and those in the agricultural space. Therefore, this proposed legislation should also direct the SBA to leverage the participation of small business resource partners to help raise greater awareness about the importance of succession planning among rural women entrepreneurs and to connect them to helpful resources. For example, Women’s Business Centers (WBCs) are each unique in their offerings, however, those with particularly strong programming covering succession planning may be well-positioned to share models of success with other WBCs, Small Business Development Centers (SBDCs), Veterans Business Outreach Centers (VBOCs)44, SCORE45 as well as other key federal agency programs and partners such as USDA.46

Congress should mandate an independent economic impact study on the effects of expanding the

estate tax exemption for an additional 10 years to 2035 and the effects of making it permanent at

the current rate for rural small businesses as well as family and women-owned farms.

Congress should mandate an independent economic impact study on the effects of expanding the

estate tax exemption for an additional 10 years to 2035 and the effects of making it permanent at

the current rate for rural small businesses as well as family and women-owned farms.

On background, as per the Congressional Research Service’s 2021 review of “Recent Changes in the Estate and Gift Tax Provisions”:

Additionally, aside from this debate, it is important to note that the Biden-Harris Administration has expressed its commitment and support for minority and women business owners, including those who inherit farmland and have been historically denied equitable access to capital. Notably, separate from the status of the estate tax exemption, the U.S. Department of Agriculture (USDA) in July 2021 announced $67 million in competitive loans through a new Heirs’ Property Relending Program (HPRP). This program “aims to help agricultural producers and landowners resolve heirs’ land ownership and succession issues. Intermediary lenders—cooperatives, credit unions, and nonprofit organizations—[were able to] apply for loans up to $5 million at 1% interest” following a two-month Farm Service Agency (FSA) signup period during fiscal year 2021.[ii] The HPRP is an example of how the Administration, via the USDA, “is working to rebuild trust with America’s farmers and ranchers. Beyond supporting participants with loans, this program has the potential to “keep farmland in farming, protect family farm legacies and support economic viability” according to USDA’s news release.48

SBA and NWBC should collaborate on efforts to better assess available quantitative and qualitative

data as well as identify gaps in research on rural minority women business owners in agriculture and

across industries.

SBA and NWBC should collaborate on efforts to better assess available quantitative and qualitative

data as well as identify gaps in research on rural minority women business owners in agriculture and

across industries.Nonetheless, women are increasingly participating in certain traditionally male-dominated industries in higher numbers, such as agriculture.51 “According to the 2017 Census of Agriculture, which counted multiple primary producers for the first time, just over 36% of American farmers are women and 56% of the farms and ranches … said that they have at least one female decision maker guiding their business.” Additionally, the 2019 Agricultural Resource Management Survey (ARMS) found that “more than half (51 percent) of all farming operations in the United States had at least one-woman operator.”52

Despite this available data, researchers have noted a remarkable deficiency “in relevant mainstream economic studies from the U.S. on topics such as gender differences in marketing, access to credit, land, value of time, technology choice, and farm management practices,”53 and in rural women’s entrepreneurship generally.54 Council Members have similarly underscored the importance of obtaining better data on U.S. rural women business owners and farm operators. As a prospective example, Council Member Jessica Flynn has highlighted for this subcommittee research currently underway and led by Dr. Ryanne Pilegram,55 an associate professor of Sociology at the University of Idaho specializing in “qualitative research that focuses on how gender intersects with rural life.” This statewide 2021 study—Women Farmers and Ranchers on the Rise in Idaho—surveyed women involved in agriculture “to better understand Idaho’s women in agriculture … [and] ways [university] extension educators and other technical assistance providers can better support the success of women farmers and ranchers in Idaho.”56

Other Council Members have expressed a strong interest in supporting similar data collection efforts, and possibly expanding the scope of this or other similar research at the national level. Council Member Rebecca Hamilton has also noted the importance of advocating for better quantitative and qualitative data collection efforts and studies, which focus on women farm operators, as well as all rural women-owned businesses.

Most significantly, this subcommittee has identified an urgent need to extrapolate specific data by demographics to better understand minority rural women business owners’ (e.g., African American, Hispanic/Latina, Native American, etc.) unique needs and barriers to entrepreneurship. In short, while there is some general data and research available on both women farm operators and rural women-owned small businesses, major gaps in research remain. As such, the Council recommends that SBA and NWBC should collaborate on efforts to better assess available quantitative and qualitative data and work to identify gaps in research on rural minority women business owners in agriculture and across industries.

NWBC should hold a roundtable in FY 2022 to review the Paid Family Medical Leave Act and further

address lack of paid family leave options for underserved rural women entrepreneurs, sole

proprietors, and business partners with infants or those planning to start a family by birth or

adoption.

NWBC should hold a roundtable in FY 2022 to review the Paid Family Medical Leave Act and further

address lack of paid family leave options for underserved rural women entrepreneurs, sole

proprietors, and business partners with infants or those planning to start a family by birth or

adoption.In fact, while a multitude of complex pandemic-related challenges plagues many rural women business-owners, the lack of affordable and available child care, particularly in rural communities and other “childcare deserts”59 is among the most significant. Notably, however, the challenge often begins as soon as the child arrives. So, while child care generally continues to be an issue of primary importance for this Council, the lack of available family and medical leave options also constitutes a closely related but separate concern impacting a woman’s decision about whether to participate in the labor force or embark on the entrepreneurial journey in the first place.60 Council Members agreed during deliberations to address the lack of Paid Family & Medical Leave (PFML) options available to women, including solopreneurs and business partners whose paycheck may not be exclusively dependent on a regular salary, but address it separately.

As Council Member Rebecca Hamilton noted, rural women entrepreneurs trying to keep their businesses afloat continue to face this serious challenge alone, without the benefit of an employer-based benefit or nationwide solution. However, Council Member Jessica Flynn added that women small business owners with few employees but wishing to scale up and grow may not be able to shoulder the cost of hiring a temporary employee and simultaneously cover the costs of leave for permanent fulltime employees. Therefore, the possibility of a “Paid Family and Medical Leave” solution that provides some measure of financial security and stability to women entrepreneurs, especially after the birth or adoption of a child, merits further exploration and careful study and should be examined separately from the ongoing general discussion on the lack of affordable and available child care.61

Currently, the debate on both child care as well as paid family and medical leave options continues to unfold on the national stage. As such, the Council strongly encourages and calls on thought leaders and lawmakers to work toward a bipartisan and innovative solution so that women entrepreneurs are “empowered with a choice about when to start a family without having to hold back on starting a business at the same time” because it would be otherwise cost-prohibitive or because there is a lack of family or community support, or both.”62 Policymakers should also seriously consider the unique circumstances of both uncovered workers and solopreneurs, particularly in rural and other underserved communities.c

More specifically, the Council recommends that NWBC hold a roundtable in fiscal year 2022 to further review the Paid Family Medical Leave Act and address lack of paid family leave options for underserved rural women entrepreneurs, sole proprietors, and business partners with infants or those planning to start a family by birth or adoption. Currently, “[o]nly 15 percent of employees have access to a defined paid family leave benefit”63 and [t]he United States is the only member of the [Organization] for Economic Co-operation and Development (OECD) that does not have a national paid family leave program, and one of two member countries lacking a national paid medical leave program.”64

The Council supports expansion of the Child Tax Credit to 2025 and encourages Congress to mandate

an economic impact study on making it permanent, specifically noting the ramifications and

prospective benefits to solopreneurs and women business owners with employees at the scaleup

stage.

The Council supports expansion of the Child Tax Credit to 2025 and encourages Congress to mandate

an economic impact study on making it permanent, specifically noting the ramifications and

prospective benefits to solopreneurs and women business owners with employees at the scaleup

stage.Notably, “women comprise 94% of workers involuntarily working part-time due to childcare challenges. To date, the Child Tax Credit has provided some relief to working American mothers. “The American Rescue Plan Act, which President Biden signed into law on March 11th,[ 2021] temporarily increase[d] the child tax credit from $2,000 to $3,000 per child ($3,600 for children 5 years old and younger) for the 2021 tax year. It also authorize[d] monthly “child allowance” payments to families from July to December.”65

There is also a proposal in the works to extend the expanded child tax credit until 2025, central to a “forming $3.5 trillion tax and spending package,”66 at the time of this writing. While the measure is described as key to addressing poverty, it may also benefit women who have been forced out of the labor force and turned to necessity entrepreneurship. If adopted, such a measure “would allow families to benefit from a credit of $3,000 for each child between ages 6 and 17, and $3,600 for each under age 6. Families could receive those sums in monthly installments, rather than waiting until they file their taxes annually to claim the benefits.”67 Some have suggested the child tax credit should be made permanent.68 An economic impact study should be conducted to ensure such a step would be in the best interest of parents, women business owners, and the overall economy.

The Council applauds the recent openings of new WBCs and encourages a continued focus on more

openings in rural and underserved communities.

The Council applauds the recent openings of new WBCs and encourages a continued focus on more

openings in rural and underserved communities.

Additionally, SBA’s Office of Women’s Business Ownership (OWBO)70 Women’s Business Center (WBC) program launched the largest expansion of WBCs in 30 years in fiscal year 2021. The Council applauds the SBA’s “grant funding and the historic launch of 20 new Women’s Business Centers (WBCs) across America to serve rural, urban and underserved communities alike. The opening of the 20 new WBCs is the largest single expansion of WBCs across America in its 30-year tenure, and these centers will be pivotal to the success of women-owned businesses as they continue to recover during this time. The WBCs will be hosted in rural and underserved markets and widen the footprint and partnership with Historically Black Colleges and Universities (HBCUs).”71

Further, the Council is also encouraged by efforts focused on promoting women-owned small businesses’ resiliency. The SBA this year “issued 14 grant awards of up to $200,000 each to organizations in 13 states as part of the … WBC Resiliency and Recovery Demonstration Grant under OWBO. The purpose of the grants is to establish or continue innovative projects that aim to improve service delivery, training, and support provided to women-owned businesses impacted by COVID-19.”72

SBA should showcase high-performing WBCs tailoring culturally competent entrepreneurial

development programming to Native, Black, and Latina business owners.

SBA should showcase high-performing WBCs tailoring culturally competent entrepreneurial

development programming to Native, Black, and Latina business owners. Additionally, the IWBC has also partnered with the University of Idaho’s College of Agricultural and Life Science to carry out focus groups to identify unique barriers to entrepreneurship for Native American women business owners. In fact, the data collected in these focus groups informed the decision to open a North Idaho office for the IWBC, currently hosted by the Moscow Chamber of Commerce.

Moreover, another potential avenue for showcasing innovative culturally competent entrepreneurial development programming is by spotlighting SBA Community Navigators Pilot Program74 grantees, including those that partner with rural WBCs and provide culturally tailored programming, resources, and networking platforms. On background, the Community Navigators Pilot Program is “an American Rescue Plan initiative designed to reduce barriers that underrepresented and underserved entrepreneurs often face in accessing the programs they need to recover, grow, or start their businesses.”75

NWBC will continue to monitor and identify high-performing WBCs, as well as other resource partners, with robust, culturally competent business development partnership and program models.

So, while women’s participation in the STEM fields has increased over the last several decades, we are still far from reaching parity78 or coming close to adequately supporting and preparing women interested in innovating or pursuing STEM entrepreneurship opportunities. On background, “in 1970, women made up 38% of all U.S. workers and 8% of STEM workers. By 2019, the STEM proportion had increased to 27% and … made up 48% of all workers.”79 Also notable, among the 70 detailed STEM occupations the Census Bureau reports on, women earned more than men in only one STEM occupation: computer network architects. However, women represented only 8% of individuals in this occupation.”80 As such, women remain underrepresented in the tech field. 81With respect to innovation and patenting, “only 22 percent of all U.S. patents list a woman as an inventor and … [make] up less than 13 percent of all inventors listed on patents for the year 2019.”82 Notably, however, “the gender gap in the number of women inventors who remain active by patenting again within five years is decreasing. For the most recent group of new inventors, 46% of women patented again in the next five years versus 52% of men.”83

Furthermore, a recent “National Academies of Sciences study finds that the pandemic may ‘roll back’ women’s gains in STEM.” Women “have been hindered as difficulties with remote work and increased caregiving responsibilities … piled up during the pandemic.”84 Council Members assert that women have come much too far to lose their rightful place in the STEM workforce, business, and the U.S. economy. Moreover, as researcher and economist at the University of Michigan Lisa Cook argues, “if women were equally represented in engineering and innovation jobs, it could increase U.S. per capita GDP by 2.7%”,85 and if more women and African Americans were to be included in the early stages of innovation, it could “increase annual U.S. GDP by almost $1 trillion.”86

Given the pervasive gender imbalances and post-pandemic challenges, the Council proposes a multifaceted, holistic policy approach to support the advancement of women in the STEM workforce, innovation, and specifically STEM entrepreneurship. This year, NWBC’s Women in STEM Subcommittee focused its policy proposals on advancing gender equity in innovation, patenting, and STEM business to better promote the commercialization of new impactful technologies with a high potential of solving real world problems. Fiscal year 2021 policy deliberations and recommendations focused on increasing STEM business mentorship and education, supporting STEM accelerator programs that work collaboratively with minority serving institutions (MSIs) and historically black colleges and universities (HBCUs), as well as advocating for enhanced data collection efforts.

NWBC applauds the White House Gender Policy Council’s (WHGPC) commitment to “advancing gender

equity and equality,” including by promoting women’s participation in STEM entrepreneurship across

industries. The Council further encourages SBA as a member of the WHGPC, specifically through the

Office of Investment and Innovation (OII), to address underrepresentation of women in innovation,

patenting, trademark, and commercialization of new technologies by identifying gaps in

research.

NWBC applauds the White House Gender Policy Council’s (WHGPC) commitment to “advancing gender

equity and equality,” including by promoting women’s participation in STEM entrepreneurship across

industries. The Council further encourages SBA as a member of the WHGPC, specifically through the

Office of Investment and Innovation (OII), to address underrepresentation of women in innovation,

patenting, trademark, and commercialization of new technologies by identifying gaps in

research.On background, the Institute for Women’s Policy Research (IWPR) 2020 report titled “Equity in Innovation: Women Inventors and Patents” compiles existing data on women and patenting. Some key takeaways from this report include the following:

Notably, similar learnings were extrapolated from NWBC’s 2020 #LetsTalkBusiness, Women in STEM roundtable discussion.90 Also, NWBC’s 2020 commissioned report titled “America’s Seed Fund: Women’s Inclusion in Small Business Innovation Research & Small Business Technology Transfer” highlights the following notable findings:

The Council supports passage of H.R. 652, the Research Advancing to Market Production (RAMP) for

Innovators Act, to improve the SBIR/STTR application peer review process by including

commercialization potential and support. Further, the Council recommends emphasizing prioritization

and inclusion of minority women entrepreneurs as well as requiring an outreach plan and impact

report that includes disaggregated data by race and gender.

The Council supports passage of H.R. 652, the Research Advancing to Market Production (RAMP) for

Innovators Act, to improve the SBIR/STTR application peer review process by including

commercialization potential and support. Further, the Council recommends emphasizing prioritization

and inclusion of minority women entrepreneurs as well as requiring an outreach plan and impact

report that includes disaggregated data by race and gender.This legislation “provides commercialization services for federally funded small business research and development under the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs” and “expedites the application award process.”93 Specifically, it would:

The Council supports passage of S. 160, the Small Business Innovation Voucher Act, that would

allow small businesses to work with any institution of higher education to compete for grants to

facilitate public-private cooperation on R&D and commercialization of new technologies. The Council

further recommends that this legislation emphasize and prioritize minority women-owned small

businesses, that a certain amount of grant funding be set aside to support women-owned businesses,

and that the report to Congress include disaggregated data on the inclusion of women and other

underrepresented populations.

The Council supports passage of S. 160, the Small Business Innovation Voucher Act, that would

allow small businesses to work with any institution of higher education to compete for grants to

facilitate public-private cooperation on R&D and commercialization of new technologies. The Council

further recommends that this legislation emphasize and prioritize minority women-owned small

businesses, that a certain amount of grant funding be set aside to support women-owned businesses,

and that the report to Congress include disaggregated data on the inclusion of women and other

underrepresented populations.Additionally, it would:

The Council recommends that SBA’s Ascent platform highlight and include relevant, existing federal

resources uniquely tailored for Women STEM entrepreneurs including links to existing SBIR/STTR

online tutorials, USPTO video trainings, and other relevant federal resources customized for women

innovators.

The Council recommends that SBA’s Ascent platform highlight and include relevant, existing federal

resources uniquely tailored for Women STEM entrepreneurs including links to existing SBIR/STTR

online tutorials, USPTO video trainings, and other relevant federal resources customized for women

innovators.This interactive digital platform includes several entrepreneurial “journeys” including: “Disaster & Economic Recovery, Strategic Marketing, Your People, Your Business Financial Strategy and Access to Capital.”102 SBA notes there are plans to add more topics over time. In this regard, Council Members recommend that the agency prioritize including relevant, existing federal resources uniquely tailored for Women STEM entrepreneurs. For example, this should include links that direct women entrepreneurs to existing SBIR/STTR online tutorials as well as any USPTO video or other federal resource featuring newly tailored trainings designed for women innovators and entrepreneurs. This may also include customized webinars offering important information on STEM entrepreneurship, innovation, and intellectual property protection resources. For example, USPTO continues to increase its outreach and resources for Women Entrepreneurs. In March 2021, USPTO hosted a Women’s Entrepreneurship Symposium, which covered helpful topics such as “government resources to assist inventors, free legal services, and support for small business owners”103 and featured an NWBC collaborator, SBA’s Chief Scientist and Program Manager for the office of Innovation and Technology, Jennifer Shieh.

The Council recommends that SBA work in close collaboration with SCORE to ensure greater diversity

of STEM mentors, and specifically recruit more women STEM business owner volunteers. SBA and SCORE

should work to significantly increase the percentage of women mentors, including women of color, by

establishing the baseline and committing to capturing metrics on an annual basis.

The Council recommends that SBA work in close collaboration with SCORE to ensure greater diversity

of STEM mentors, and specifically recruit more women STEM business owner volunteers. SBA and SCORE

should work to significantly increase the percentage of women mentors, including women of color, by

establishing the baseline and committing to capturing metrics on an annual basis.According to the organization, in 2020, “mentors helped start 45,027 businesses, create[d] 74,535 non-owner new jobs and 119,562 total new jobs.” SCORE also asserts that “small business owners who receive three or more hours of mentoring report higher revenues and increased growth.”105 Council Members opine that the organization’s platform and impressive volunteer network could be leveraged even further to help support STEM entrepreneurs. Therefore, NWBC recommends that the SBA work closely with SCORE to explore viable opportunities to increase the percentage of women STEM business owner volunteers, specifically women of color. SBA and SCORE should track progress in this regard by establishing the baseline and committing to capturing and reporting metrics on an annual basis.

The Council supports the passage of H.R. 2027, the MSI STEM Achievement Act, to increase STEM

education at minority serving institutions of higher education. The Council further recommends

prioritization of MSIs and HBCUs that partner with WBCs or other community-based programs focused on

women’s business enterprise.

The Council supports the passage of H.R. 2027, the MSI STEM Achievement Act, to increase STEM

education at minority serving institutions of higher education. The Council further recommends

prioritization of MSIs and HBCUs that partner with WBCs or other community-based programs focused on

women’s business enterprise.

Additionally, the legislation calls for the Office of Science and Technology Policy (OSTP) to “develop a uniform set of policy guidelines for federal science agencies to carry out a program of outreach activities to increase clarity, transparency, and accountability for federal science agency investments in STEM education and research activities at minority-serving IHEs … and submit to Congress a report containing a strategic plan for each federal science agency to increase the capacity of minority-serving IHEs to compete for grants, contracts, or cooperative agreements and to encourage such IHEs to participate in federal programs.”108

The Council also strongly recommends that this legislation prioritize MSIs and HBCUs that are currently partnering with WBCs or other community-based programs specifically focused on supporting women’s business enterprise.

The Council supports passage of S. 64, the Ushering Progress by Leveraging Innovation and Future

Technology (UPLIFT) Act, which would create an Innovation Centers Program within SBA with the aim to

provide HBCUs, MSIs, and community colleges with the resources to establish and expand incubators

and accelerators for the underserved.

The Council supports passage of S. 64, the Ushering Progress by Leveraging Innovation and Future

Technology (UPLIFT) Act, which would create an Innovation Centers Program within SBA with the aim to

provide HBCUs, MSIs, and community colleges with the resources to establish and expand incubators

and accelerators for the underserved. Under such a program, the SBA could “enter into cooperative agreements to provide financial assistance to historically Black colleges and universities, minority-serving institutions, and community colleges. Such entities must then undertake five-year projects operating as an innovation-focused small business accelerator or incubator. These projects must [also] involve working with underserved groups.”112

The Council encourages passage of H.R. 204, the STEM Opportunities Act, which in part provides for

guidance, data collection, and grants for groups historically underrepresented in STEM education at

institutions of higher education and at federal science agencies, and also encourages recruitment

and retention of minority students and career staff.

The Council encourages passage of H.R. 204, the STEM Opportunities Act, which in part provides for

guidance, data collection, and grants for groups historically underrepresented in STEM education at

institutions of higher education and at federal science agencies, and also encourages recruitment

and retention of minority students and career staff.b. Note: Small business resource partners are also critical in helping amplify awareness and facilitate access to succession planning resources. Council Member Bonnie Nawara has noted however, that typically most Women’s Business Centers (WBCs) and other small business resource partners’ focus and resources are generally directed at addressing needs in the startup and growth phases of a business, rather than on succession planning. “Often, a business will not even think about a succession plan until 7-10 years down the road.”

c. Note: Council Member Rebecca Hamilton shared during deliberations that entrepreneurs who work for themselves have unique needs—they are not in the same circumstance as a covered, salaried employee. Looking at the restaurant industry as an example, where a partner may not receive a salary but instead is paid with dividends, paid family and medical leave options may not only be limited and cost prohibitive, but these options may also not even exist. Women who want to start a business and be a mother should have the same choice as a salaried employee—they should have the ability to start that new business and start a family at the same time, if that is what they choose.

RESILIENCY RESOURCES

▪ The Office of Women’s Business Ownership (OWBO) 117 | OWBO assists women entrepreneurs through programs coordinated by SBA district offices.118 Programs include business training, counseling, federal contracts, and access to credit and capital. ▪ Women’s Business Centers (WBCs)119 | WBCs provide free, to low-cost counseling and training and focus on women who want to start, grow, and expand their small business. These centers seek to level the playing field for all women entrepreneurs, who still face unique obstacles in the business world. WBCs serve a wide diversity of geographic areas, demographic populations, and economic environments. Many centers offer training and counseling in a various languages and dialects, helping reach underserved markets with unique and innovative programs. Businesses receiving assistance from WBCs see a significantly better success rate than those without similar support.

▪ Small Business Development Centers (SBDCs) 122 | The Small Business Development Center Program offers one-stop assistance to individuals and small businesses by providing a variety of information and guidance in central and easily accessible branch locations. The program is a cooperative effort of the private sector, the educational community as well as federal, state, and local governments. It enhances economic development by providing small businesses with management and technical assistance.

▪Veterans Business Outreach Center (VBOC)123 | The VBOC program is designed to provide entrepreneurial development services such as business training, counseling, and resource partner referrals to transitioning service members, veterans, National Guard & Reserve members, and military spouses interested in starting or growing a small business.

▪ Learning Center124 | This webpage provides variety of online courses to help entrepreneurs start and run a business. SBA’s online learning programs are designed to empower and educate small business owners every step of the way.

▪ Local Assistance127| Find a number of local partners that counsel, mentor, and train small business entrepreneurs, by zip code.

▪ Recovery Hub128| Provides resiliency resources to help businesses rebuild, keep employees safe and healthy, and help small businesses revitalize their communities, particularly when health crises, hurricanes, and other disasters arise.

Federal Contracting

▪ Women-Owned Small Businesses (WOSB) Federal Contracting Program129 | This program helps women-owned small businesses compete for federal contracts. It is important you understand the eligibility requirements before applying.130

☐ Be at least 51% owned and controlled by women who are U.S. citizens

☐ Have women manage day-to-day operations who also make long-term decisions

☐ Be owned and controlled by one or more women, each with a personal net worth less than $750,000

☐ Be owned and controlled by one or more women, each with $350,000 or less in adjusted gross income averaged over the previous three years

☐ Be owned and controlled by one or more women, each $6 million or less in personal assets

» To learn more about the application process, access SBA’s “Will You Be WOSB Ready?" fact sheet available online at: beta.certify.sba.gov fact sheet.

SBA Funding

▪ SBA Loan Programs 135| Women-owned small businesses can also take advantage of SBA loan programs. SBA works with lenders to provide loans to small businesses. The agency does not lend money directly to small business owners. Instead, it sets guidelines for loans made by its partnering lenders, community development organizations, and micro-lending institutions. SBA reduces risk for lenders and makes it easier for them to access capital. That makes it easier for small businesses to get loans. Agency partners offer advice and counseling to help small business owners choose the right path for their company.

»The Certified Development Companies (CDCs)/504 Loan Program137 | The 504 Loan program provides long-term, fixed rate financing of up to $5 million for major fixed assets that promote business growth and job creation. (CDCs are certified and regulated by SBA.) This type of loan can be used for a range of assets that promote business growth and job creation. These include the purchase or construction of existing buildings or land, new facilities, long-term machinery, and equipment. Also eligible is the improvement or modernization of land, streets, utilities, parking lots and landscaping, or existing facilities.

» Microloans138 | The microloan program provides loans up to $50,000 to help small businesses and certain not-for-profit childcare centers start up and expand. The average microloan is about $13,000.

SBA Grants

▪ SBA Grants141| SBA provides limited small business grants and grants to states and eligible community organizations to promote entrepreneurship.

» SBA’s State Trade Expansion Program (STEP) 143 | Through awards to U.S. states and territories, STEP helps small businesses overcome obstacles to exporting by providing grants to cover costs associated with entering and expanding into international markets. STEP financial support helps U.S. small businesses:

☐ Participate in foreign trade missions

☐ Design international marketing products and campaigns

☐ Support website globalization and e-commerce capabilities

☐ Pay for subscriptions to services provided by the U.S. Department of Commerce and other federal agencies

☐ Participate in export trade show exhibits and training workshops

☐ Providing ongoing orientations for employers, unions, and workers on creating a successful environment for women to succeed in those careers; and

☐ Setting up support groups, facilitating networks, and/or providing support services for women to improve their retention.

▪ USDA Minority Women Farmers and Ranchers 147| USDA’s Farm Service Agency targets a portion of all Guaranteed loan funds, Direct Operating and Direct Farm Ownership loan funds, Microloan funding, and Youth loans, to historically underserved farmers and ranchers.

▪ Women’s Services, US Department of Transportation 150 | The Women Procurement Assistance Committee (WPAC) at the U.S. Department of Transportation (DOT) established WPAC through the Office of Small and Disadvantaged Business Utilization (OSDBU) to promote, coordinate and monitor DOT procurement plans and programs. The Committee provides forums, workshops, and best practices to contribute to the growth and economic development of women.

▪ System for Award Management (SAM.gov) 151 | SAM.gov has merged with beta.SAM.gov. All content from both sites is now available at SAM.gov. This is an official website of the U.S. Government for registering to do business with the federal government. Registration on this site is free.

▪ Grants.gov 152 | This is the federal government’s one-stop shop to search for government grant opportunities.

▪ Association for Enterprise Opportunity (AEO)153 | “Since 1991, AEO and its member and partner organizations have helped millions of entrepreneurs contribute to economic growth while supporting themselves, their families and their communities. AEO’s more than 1,700 members and partners include a broad range of organizations that provide capital and services to assist underserved entrepreneurs in starting, stabilizing and expanding their businesses.”

▪ Association of Women’s Business Centers (AWBC)154 | “The AWBC works to secure economic justice and entrepreneurial opportunities for women by supporting and sustaining a national network of more than 100 Women’s Business Centers (WBC). WBCs help women succeed in business by providing training, mentoring, business development, and financing opportunities to over 150,000 women entrepreneurs each year.”

▪ Gender Equality in Tech (GET) Cities155 | GET Cities “is an initiative designed to accelerate the representation and leadership of women in tech through the development of inclusive tech hubs across the United States.”

▪ National Association of Women in Construction (NAWIC)156 | Founded in 1953, “NAWIC is … based in Fort Worth, [Texas] and has over 115 chapters throughout the United States that provide its members with opportunities for professional development, education, networking, leadership training, public service and more. NAWIC continues … [to advocate] for the value and impact of women builders, professionals and tradeswomen in all aspects of the construction industry.”

▪ National Association of Women in Real Estate Businesses (NAWRB)157 | “NAWRB is a leading voice for women in the housing ecosystem … advocating for women’s gender equality, raising the utilization of women-owned businesses and providing women the tools and opportunities for economic expansion and growth.

▪ National Association of Women’s Business Owners (NAWBO)158 | “Founded in 1975, the National Association of Women Business Owners (NAWBO) is the unified voice of over 11.6 million women-owned businesses in the United States representing the fastest growing segment of the economy.”

▪ Startup Champions Network159 | Startup Champions Network is a professional association of entrepreneurial ecosystem builders. Members are individual system weavers who are committed to entrepreneurship as a tool to make communities better. “Entrepreneurial ecosystem builders come from a variety of backgrounds and expertise, including entrepreneurs, government officials, economic developers, grassroots community leaders, university leaders, academics, philanthropists, corporate leaders, and media.”

▪ U.S. Women’s Chamber of Commerce (USWCC) 160| USWCC is focused on helping “women start and build successful businesses and careers, gain access to government contracts, grow as leaders and prepare for a secure retirement.”

▪ Walker’s Legacy161 | Focused on “cultivating the whole woman,” Walker’s Legacy “is a global platform for professional and entrepreneurial multicultural women.” The organization notes it exists “to inspire, equip, and engage through thought-provoking content, educational programming, and a global community.”

▪ Women’s Business Enterprise National Council (WBENC)162 | “WBENC was founded in 1997 to develop a nationwide standard for women-owned business certification. Since then, the organization has grown to become the largest third-party certifier of businesses owned, controlled, and operated by women in the United States and a leading advocate for women-owned businesses in corporate and government supply chains … [As a] 501(c)(3) non-profit, WBENC partners with 14 Regional Partner Organizations.

▪ Women Impacting Public Policy (WIPP) 163| WIPP is a national nonpartisan organization advocating on behalf of women entrepreneurs—strengthening their impact on our nation’s public policy, creating economic opportunities, and forging alliances with other business organizations … Since its inception in June of 2001, WIPP has reviewed, provided input, and taken specific positions on many economic issues and policies which affect [women-owned businesses].”

▪ Women Presidents Organization 164| WPO “is a nonprofit membership organization for women presidents of multimillion-dollar companies. The members of the WPO take part in professionally facilitated peer advisory groups in order to… accelerate the growth of their businesses… The organization was formed to improve business conditions for women entrepreneurs, and to promote the acceptance and advancement of women entrepreneurs in all industries.”

▪ The Vinetta Project 165| Described as a “Capital Platform that sources, funds and supports the world’s most promising female founders—providing great outcomes for our startups and superior returns for investors and partners.”

▪ Babson College Center for Women’s Entrepreneurial Leadership (CWEL) 166| CWEL educates and empowers “women to create social and economic impact through industry and innovation as we research and enlighten the global community about the importance of female leadership for prosperity and human progress … CWEL’s award-winning programs, exclusive events, access to cutting-edge experts, and hands-on coaching impact a diverse set of stakeholders from around the world.”

▪ Association for Women in Science (AWIS) 167| “For individuals seeking equity for women in science, engineering, technology and math, AWIS provides career development, networking, mentorship, and leadership opportunities. In addition … thought leadership, research, and advocacy benefit all women in science.”

Principal Managing Partner of Cober Johnson & Romney

Founder and CEO of the Vinetta Project

Founder & CEO of Red Sky

Co-CEO of Badger

Owner and CEO of KLK Construction

President & CEO of Nation Waste, Inc.

CEO of the Association for Women in Science (AWIS)

Robert loves to “speak geek” and has supported the national engineering and manufacturing communities through leadership roles at Eastern Michigan University’s Center for Entrepreneurship, Society of Manufacturing Engineers and Corporation for a Skilled Workforce. She is an avid advocate for the advancement of women in STEM careers, believing that it is imperative to bring the vast expertise of women to bear in solving the world’s grand challenges.Robert has a B.A. from the University of Michigan and pursued graduate studies in Operations Management at Eastern Michigan University. She is a certified association executive (CAE) through the American Society of Association Executives (ASAE). Robert and her husband have three children and four grandchildren, and share personal passions for hiking, traveling, renovating historic homes, and spending lazy afternoons on the porch.

Founder and CEO of Natalie’s Orchid Island Juices

Over the past eight years, Sexton has built a growing succession team for Natalie’s that has tripled the size of the company. With annual sales in 2018 topping $60 million, the company continues to grow and have a strong brand presence. Sexton continues to oversee all facets of the company from manufacturing to innovation and new product development. Natalie’s has been ranked as one of the nation’s fastest-growing private companies by Inc. Magazine two years in a row.Sexton is a member of the National Women’s Business Council in Washington, D.C. and was recently awarded the Women in Manufacturing STEP Award, which honors just 130 women each year that have demonstrated excellence and leadership in their careers in the manufacturing sector. Her business success story was recently profiled in Forbes Magazine. One of Marygrace’s newest endeavors is her non-profit organization, A-GAP, founded in January 2018. A-GAP is a foundation that encourages people to create freedom from technology so they can engage in community, explore creation, enhance creativity, & execute change. A-GAP weekend reprieves help individuals experience contemplation & spiritual rejuvenation to improve their personal relationships and professional performance. Sexton is based in Vero Beach, FL with her husband, Bobby, with Natalie’s headquarters based in Fort Pierce, FL. The couple has two daughters, Natalie and Lucy, and one granddaughter, Isabel.

President & CEO of greiBO

CEO and Founder of REUNIONCare Inc.

Executive Director

Senior Policy Advisor

Program and Operations Manager

1 “Annual Business Survey (ABS) Program.” Census.gov. United States Census Bureau, last modified October 8, 2021. https://www.census.gov/programssurveys/abs.html; “Nonemployer Statistics by Demographics (NES-D) Tables.” Census.gov. United States Census Bureau, last modified October 8, 2021. https://www.census.gov/programs-surveys/abs/data/nesd.html.

2 Kelley, Donna, Mahdi Majbouri, and Angela Randolph. “Black Women Are More Likely to Start a Business than White Men.” Consumer Behavior. Harvard Business Review, May 11, 2021. https://hbr.org/2021/05/blackwomen-are-more-likely-to-start-a-business-than-white-men. Note: Black women are starting businesses at a higher rate than other demographic groups but are also closing them faster.

3 “American Community Survey (ACS).” Census.gov. United States Census Bureau, November 24, 2021. http://www.census.gov/programs-surveys/acs/. Note: This data is extrapolated from the 2018 American Community Survey (ACS). For additional information on the ACS visit Census.gov.

4 “Census Bureau Releases New Report on Veterans.” Census.gov. United States Census Bureau, last modified October 8, 2021. https://www.census.gov/newsroom/press-releases/2020/veterans-report.html. Note: This data is extrapolated from the 2018 American Community Survey (ACS). For additional information on the ACS visit: American Community Survey (ACS) (census.gov), www.census.gov/programs-surveys/acs/.

5 U.S. Census Bureau. “Women’s History Month: March 2021.” Census.gov. United States Census Bureau, March 2, 2021. https://www.census.gov/newsroom/facts-for-features/2021/womens-history-month.html.

6Williams, Victoria. “Women-Owned Employer Businesses.” Small Business Facts. U.S. Small Business Administration Office of Advocacy, April 2021. https://cdn.advocacy.sba.gov/wp-content/uploads/2021/08/03103255/Small-Business-Facts-Women-Owned-Businesses.pdf.

7Teare, Gené. “Global VC Funding to Female Founders Dropped Dramatically This Year.” Crunchbase News. Crunchbase News, December 21, 2020.

8“2021 WIPP Policy Priorities.” Women Impacting Public Policy. Women Impacting Public Policy, 2021. https://www.wipp.org/page/PolicyPriorities.

9Dilger, Robert Jay. “SBA Women-Owned Small Business Federal Contracting Program.” Congressional Research Service, November 10, 2021. https://sgp.fas.org/crs/misc/R46322.pdf.

10“Executive Order on Establishment of the White House Gender Policy Council.” The White House. The United States Government, March 8, 2021. https://www.whitehouse.gov/briefing-room/presidentialactions/2021/03/08/executive-order-on-establishment-of-the-white-housegender-policy-council/.

11Bittner, Ashley, and Brigette Lau. “Women-Led Startups Received Just 2.3% of VC Funding in 2020.” Harvard Business Review. Harvard Business Review, September 17, 2021. https://hbr.org/2021/02/women-led-startupsreceived-just-2-3-of-vc-funding-in-2020.

12Minority Entrepreneurship Grant Program Act of 2021. Bill, Congress. Gov § (2021). https://www.congress.gov/bill/117th-congress/senatebill/1109?s=1&r=9.

13Minority Entrepreneurship Grant Program Act of 2021. Bill, Congress. Gov § (2021). https://www.congress.gov/bill/117th-congress/senatebill/1109?s=1&r=9.

14Next Generation Entrepreneurship Corps Act. Bill, Congress.Gov § (2021). https://www.congress.gov/bill/117th-congress/senate-bill/389/all-info.

15Next Generation Entrepreneurship Corps Act. Bill, Congress.Gov § (2021). https://www.congress.gov/bill/117th-congress/senate-bill/389/all-info.